School Vouchers Would Increase Costs for Local Taxpayers

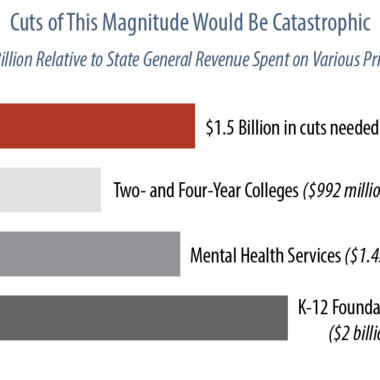

State lawmakers are considering legislation that would expand the Missouri Empowerment Scholarship Accounts Program, or vouchers. While the financial impact of vouchers would vary widely by district, some increases could be substantial and may require a local tax increase. Read More