Introduction to Missouri’s State Budget (2023)

Off

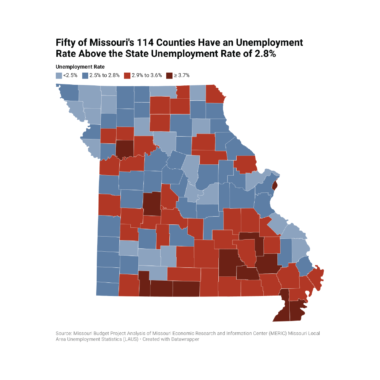

The Missouri Budget Project’s “Introduction to Missouri’s State Budget” outlines Missouri’s budget process, including where the state’s revenue comes from and how the state allocates funding. State Budget & Taxes: Impact at a Glance The impacts of Missouri’s investments are Read More