- Working families with low-wages may earn too little money to owe income taxes, but they contribute significant portions of their income to state general revenue in sales and property taxes.

- In fact, in Missouri, the lower your earnings, the more you pay in state and local taxes as a share of what you make: according to the most recent analysis, Missouri families in the bottom quintile of income pay 9.9% of their income in state and local taxes, compared to just 6.2% for the wealthiest 1% of families.

Strengthen the Working Families Tax Credit

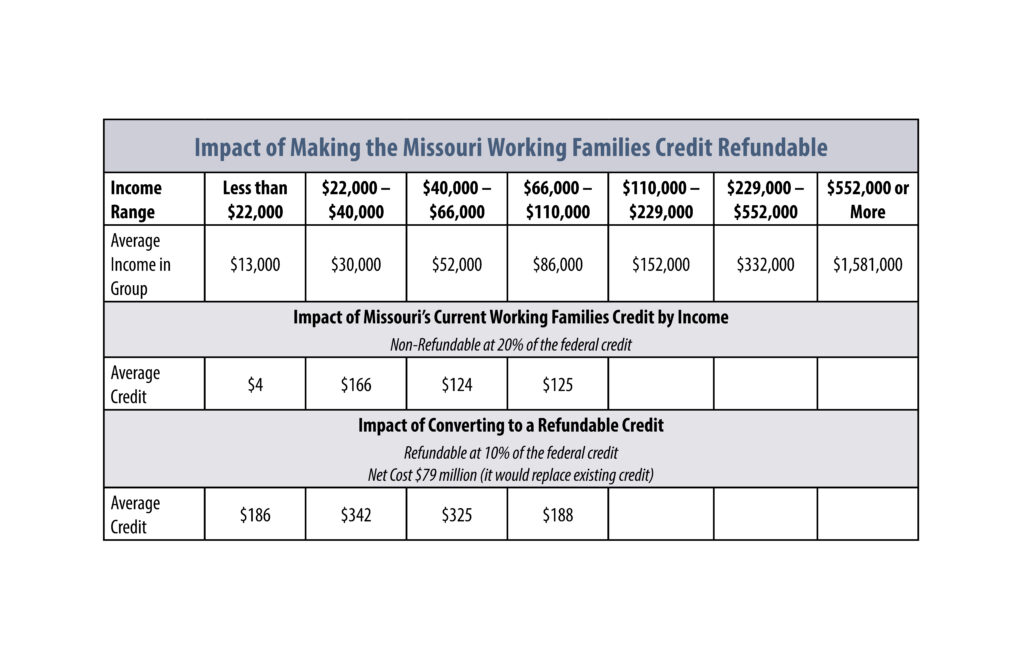

Missouri lawmakers approved a Working Families Credit that is being implemented in 2023. The credit is based on income tax liability. As a result, it will not offset the considerable increases in sales tax that families are facing due to inflation in costs for everyday items that are subject to that tax, like diapers, food, and other basics.

Making the credit refundable will not only reach more working families, but also unleash its full impact.

- Eligibility for the credit is based on family size and income. Currently, a family with three children is eligible with an income up to $59,000. As incomes increase, the credit phases out.

- Research has documented that while most families receive the similar federal Earned Income Tax Credit (EITC) only temporarily, it has profound long-term benefits for families and communities.

- Children whose families receive the federal EITC are healthier, do better and go farther in school, and enjoy greater earnings as adults, establishing a more productive and skilled workforce for Missouri’s future.

- Refundable state credits build on that success and contribute to child welfare. In fact, states with refundable credits have seen marked reductions in the rates of child maltreatment and reduced foster care entries compared to states without an EITC.

Because of its profound impact, President Ronald Reagan proposed expansion of the federal EITC in 1986, calling it, “the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress.”

While Missouri’s current credit will reach an estimated 250,000 families, making the credit refundable as Reagan supported, would reach 492,430 working families – maximizing the impact for Missouri families and kids.

Making the Missouri Working Families Credit fully refundable would have profound impacts for families in every community across Missouri.

The following map shows the percent of households eligible for the federal Earned Income Tax Credit by County and by Missouri State Senate and State House districts.