MBP Statement on Income Tax Proposal in State of State Address

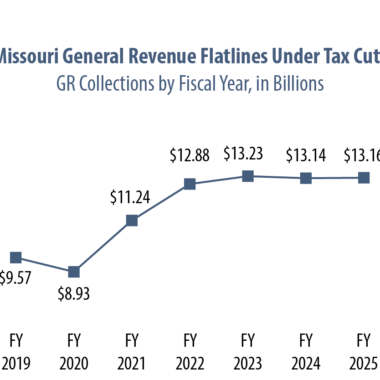

For Immediate Release: January 28, 2025Contact: Traci Gleason MBP Response to Income Tax Proposal in State of State AddressStatement by Amy Blouin, President and CEO, Missouri Budget Project “Whether it happens over time or all at once, eliminating the state income tax wipes out Read More