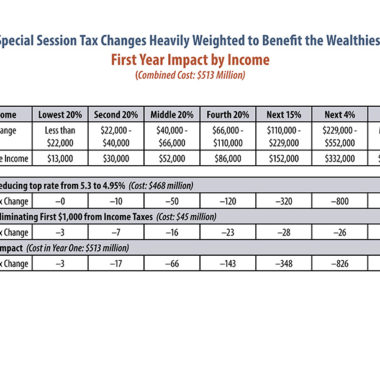

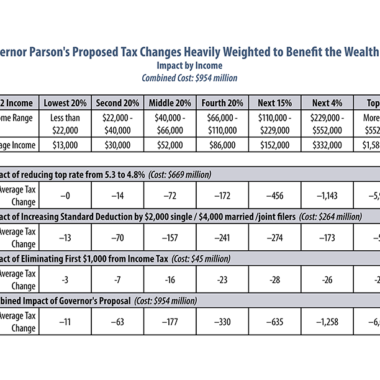

Impact of Special Session Tax Package by Income

Updated November 16th, 2022: The earlier version showed an incorrect figure for the impact of reducing the top rate from 5.3 to 4.3% on the middle 20% of income earners. The earlier version showed -155; the correct figure is -115. Read More