Pain of Missouri’s 2005 Missouri Medicaid Cuts Holds Lessons for Today

Off

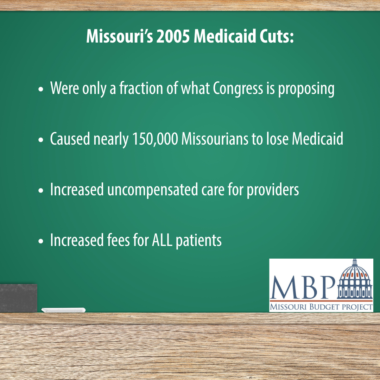

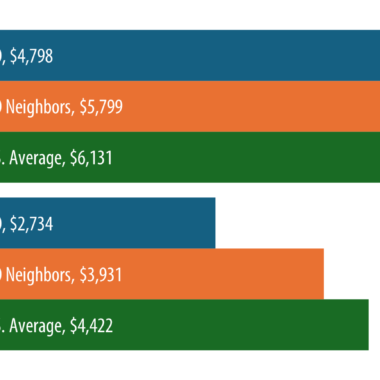

State Medicaid cuts made in 2005 – which are only a fraction of the size of the cuts being discussed today – caused nearly 150,000 Missourians to lose Medicaid coverage, increased the number of uninsured Missourians, and led to increased costs for providers and patients. The Read More