Improving Missouri’s Working Families Tax Credit

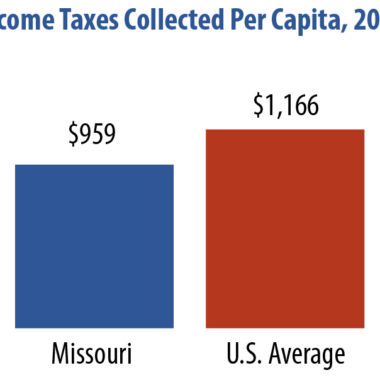

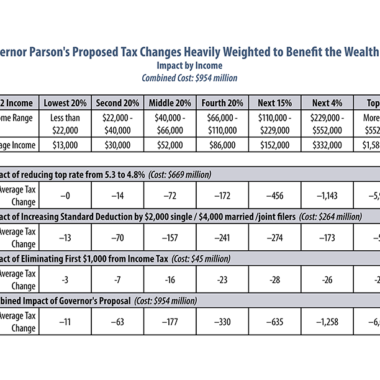

Working families with low-wages may earn too little money to owe income taxes, but they contribute significant portions of their income to state general revenue in sales and property taxes. In fact, in Missouri, the lower your earnings, the more you pay in state and local taxes Read More