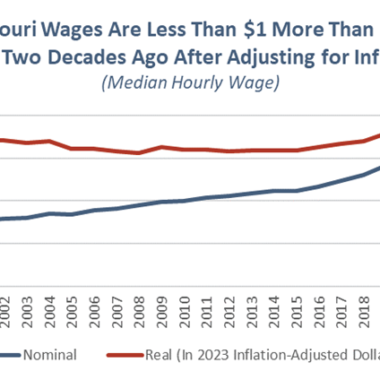

State of Working Missouri: Low Paid Workers Struggle to Get Ahead

Missourians harvest the food we eat, build local homes and businesses, keep our communities safe, and teach our children. They are the engines of our economy, supplying the products and services we use every day. Those same Missourians are consumers, providing customers to Read More