Home Page Slider

SNAP Participation and Economic Impact by County

SNAP Helps Missourians in Every County SNAP Boosts Local Economies Amid rising food prices, over 324,000 Missouri households (including nearly 275,000 children) rely on the Supplemental Nutrition Assistance Program (SNAP) to help pay for food. Most SNAP-participating households Read More

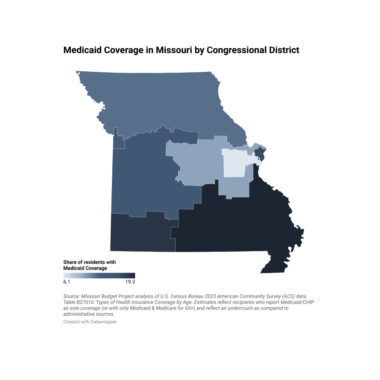

Medicaid 101: An Overview of MO HealthNet & the Children’s Health Insurance Program

Off

NOTE: Federal legislation enacted in July 2025 will cause major changes to Medicaid. These changes will be implemented over time, and this primer has not been updated to reflect the cuts from the One Big Beautiful Bill. For more information on the impact of the OBBB on health Read More

Budget, Senior Groups Respond to Audit Report on Missouri Property Tax Credit

Legislature Urged to Update Credit to Serve Missourians For Immediate Release: November 13, 2024 Missouri Auditor Scott Fitzpatrick raised some critical points about ways that the Missouri Property Tax Credit has become less effective for the very Missourians it was designed to Read More

Property Tax Freeze for Older Adults May Provide Some Future Support, But More Must Be Done

Off

Recent dramatic increases in housing values and property tax assessments in counties across Missouri have resulted in steep property tax increases for many homeowners, threatening housing stability for older adults, many of whom live on fixed incomes and are at risk of being Read More

Addressing the Myths

We’ve heard it all before – the tired myths about the effects of the minimum wage on the economy. But not only do national studies consistently show little impact on jobs, we only have to look at previous wage increases in Missouri to see the truth. Following the last minimum Read More

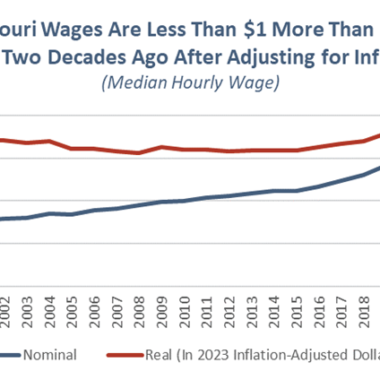

State of Working Missouri: Low Paid Workers Struggle to Get Ahead

Missourians harvest the food we eat, build local homes and businesses, keep our communities safe, and teach our children. They are the engines of our economy, supplying the products and services we use every day. Those same Missourians are consumers, providing customers to Read More

Caregiving Sector Employers Would Benefit from Improved Workforce Stability Achieved by Earned Sick Leave & Minimum Wage Policies

A stable caregiving workforce is critical to ensuring that children, older adults, and those with disabilities receive the high-quality care they need and deserve. Yet the care sector – which includes childcare workers, home health aides, and workers in mental health and child Read More