MBP Statement: Tax Bills Put Profit Margins Before People

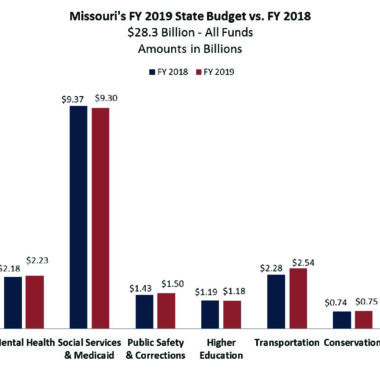

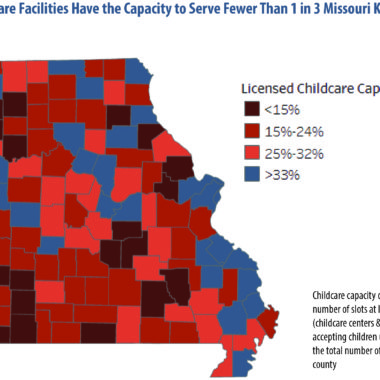

For Immediate Release, May 17, 2018 Lawmakers are set to give a huge tax break to profitable corporations while undermining our ability to fund schools, health, roads, and other things Missourians need. At the same time, lawmakers are considering scrapping a tax credit that would Read More