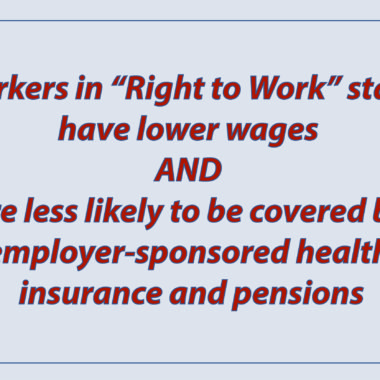

“Right to Work” Could Lower Wages & Benefits for ALL Missourians

Download the PDF Version “Right to Work” (RTW) would reduce wages and benefits like health insurance coverage for all workers – both union and non-union. Because of its negative impact on the middle class and quality jobs, the Missouri Budget Project urges Missourians to vote NO Read More