Wages

For workers managing their household budgets, wages are one of the most important ways to judge the quality of a job. This section first provides a perspective on wage growth over time at the national level, then uses recent state level wage and economic data to examine how working Missourians are faring, especially post-COVID.

NATIONAL WAGE TRENDS

Wages Have Been Flat Despite Strong Growth:

Economic Gains Have Shifted Towards Corporate Profits, CEO Compensation

The Link Between Productivity and Pay Has Long Been Broken

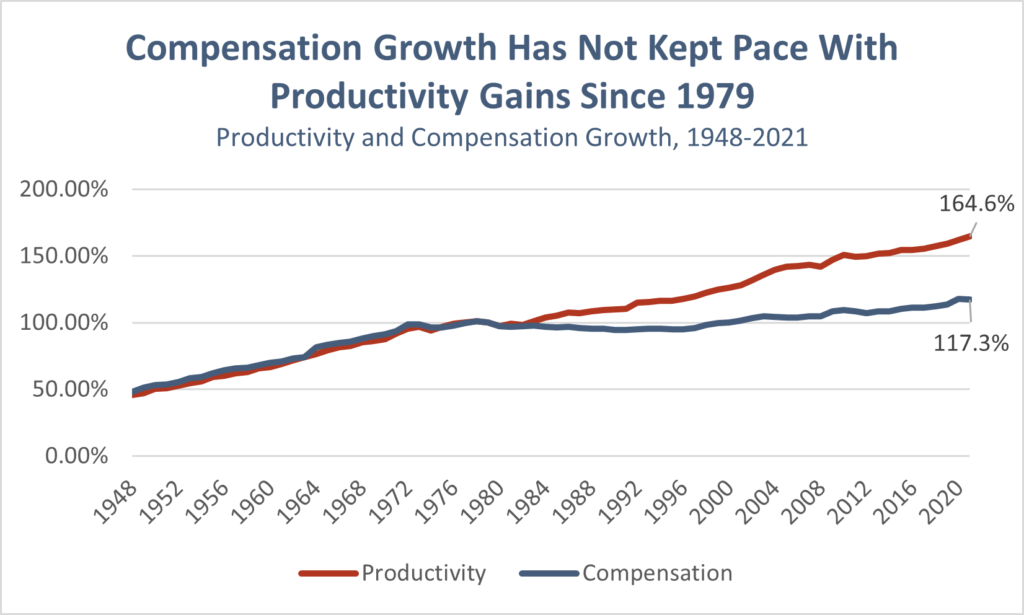

It used to be that as the economy grew, business owners and workers alike shared the benefits. In the post-World War II era, as productivity increased (that is, as more income was generated across the economy as a whole), those gains were shared with many of the workers who helped produce it, and wages grew.

However, the link between productivity and pay has been broken. Until 1979, pay and productivity grew together. Since then, productivity grew nearly 4 times faster than the rate of pay – and the benefits of economic growth are now mostly found in corporate profits and pay for those at the top.

From 1948 – 1979, productivity and compensation were tightly linked.

In the last generation, productivity increased nearly 65% – but wages only by 17%.

It is important to recognize that not all Americans shared equally in postwar affluence. Black workers were excluded from many opportunities that allowed white workers to increase their earnings and build wealth, as were women and other workers of color in some cases. The effect of discriminatory policies is still seen in earnings and wealth today.

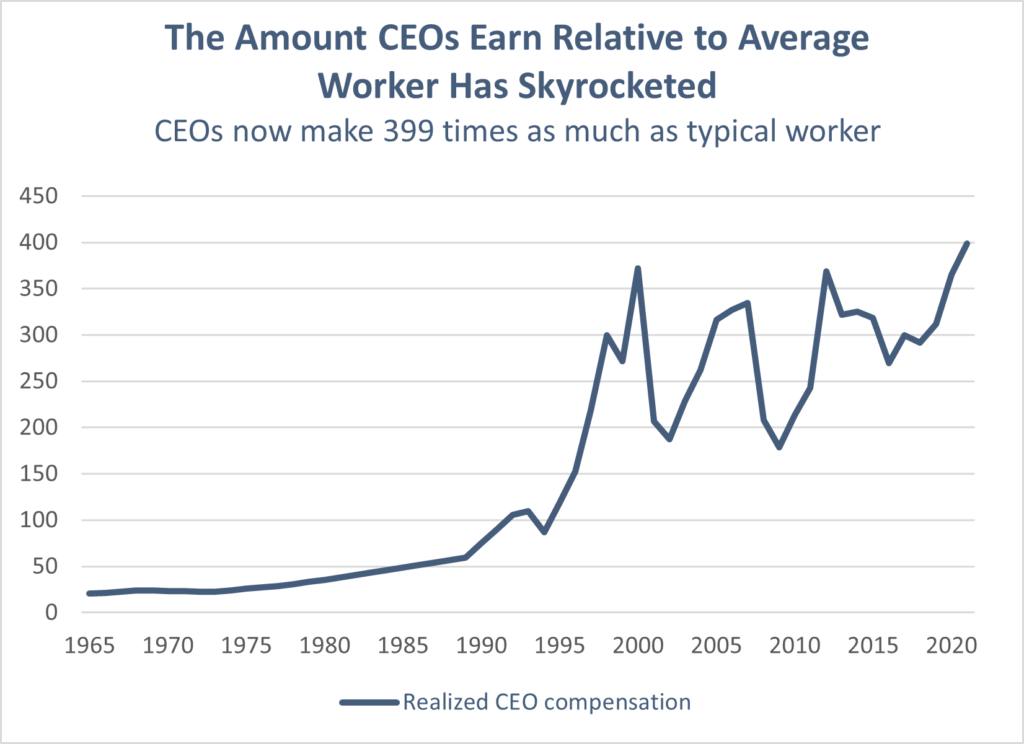

Meanwhile the Ratio of CEO to Worker Compensation Has Skyrocketed

Around the same time that the productivity-pay link was broken, there was a marked change in how much corporate CEOs were paid relative to the average worker. Taking into account the value of cashed in stock options in addition to salary, in 1965 the average CEO made about 20 times more than the average worker. By 1989, a typical CEO made 59.3 times more than a typical worker. The size of this disparity has increased rapidly since then, with CEOs being paid 399 times as much as a worker in 2021.

MISSOURI WAGE TRENDS

Missouri Workers Face Rising Inflation, Stagnant Wages

Median Wages in Missouri Have Been Stagnant

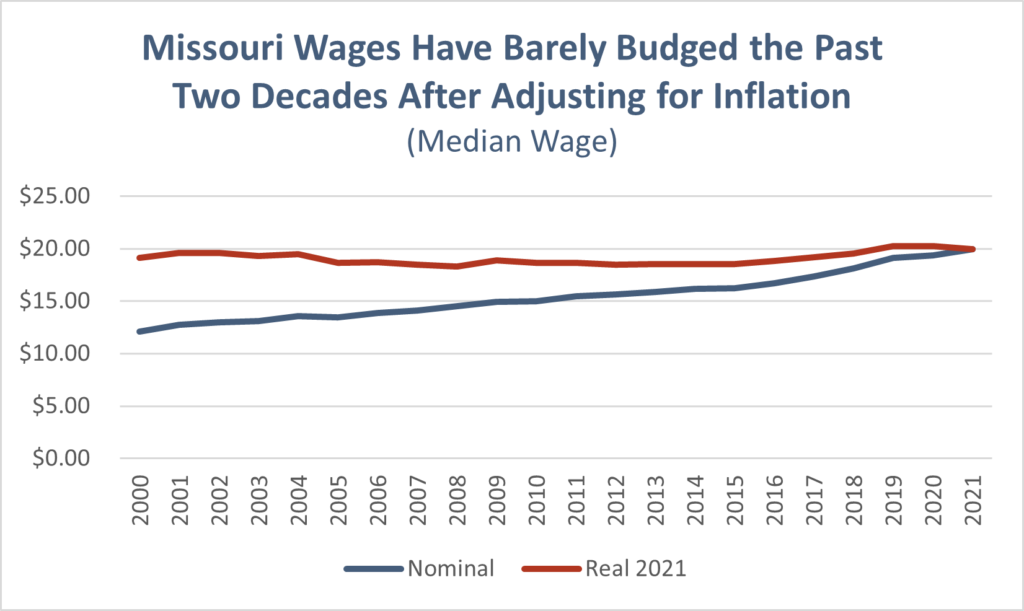

The disparity in compensation has left Missouri workers falling further behind. While the median wage in Missouri has nominally increased, the real value of those wages has been stagnant since the turn of the century. In 2000, a worker earning the median wage made $12.12 an hour – the equivalent of $19.13 after adjusting for inflation (in 2021 dollars).

Earnings have barely budged since then. In 2021, a worker earning the median wage made just $19.92 an hour, meaning half of Missouri workers earned more, and half earned less. Nearly 1 of every 3 workers made about $15 an hour or less.

The Post-Pandemic Period: Inflation is Taking a Bite Out of Workers’ Pocketbooks

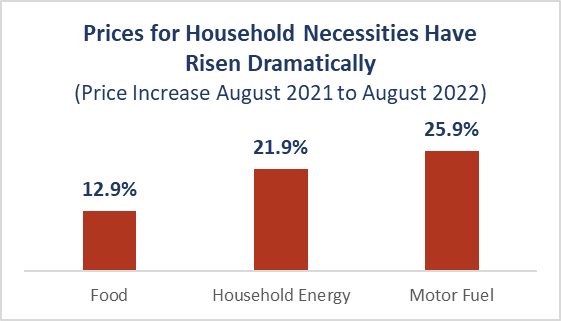

Recent inflationary growth is compounding the economic struggle for workers. Over the past year and a half, workers have seen a sharp increase in the prices of everyday household necessities, such as food, gas, and utilities. From August 2021 to August 2022, food prices rose 12.9% − the largest increase since February 1979.

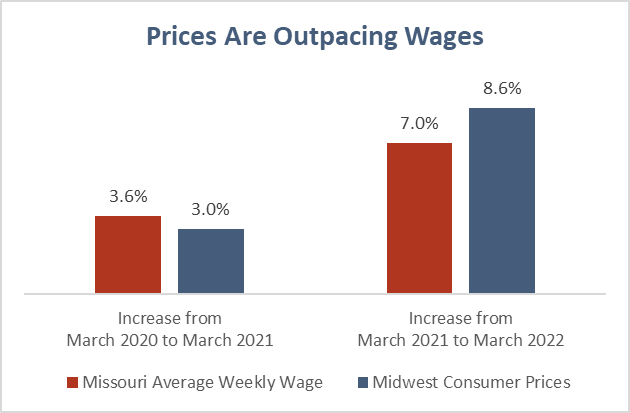

While workers have seen pay increases since the pandemic, that wage growth has been relatively slow compared to rising consumer prices. This disparity indicates nonwage factors are the main reasons for the onset of this current wave of inflation.

Instead, inflation has largely been driven by corporate profits and supply chain issues – and it has diminished the wage gains workers have made over the past two years.

Corporate Profits Have Driven Inflation

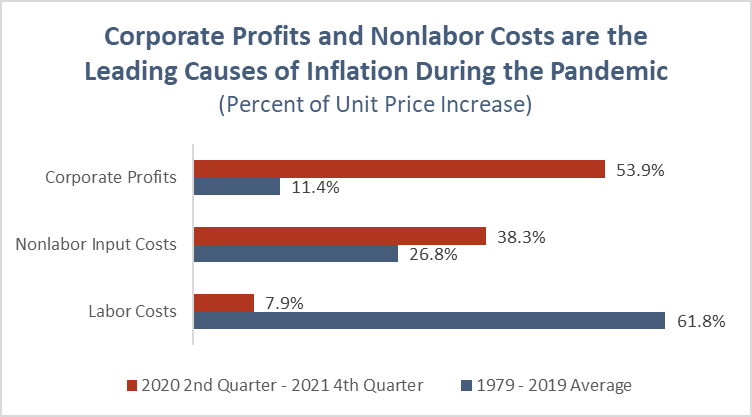

Strikingly, the data indicate that it didn’t have to be this hard. From 2020 through 2021, nearly 54% of the increase in an item’s price can be attributed to corporate profit, followed by nonlabor costs (38%), and the cost of labor (8%). This is the reverse of what one might expect to see compared to historical trends. In fact, as shown in the chart below, the rise in corporate profits during the pandemic has been extreme compared to the preceding 40 years.

While corporate decisions have reaped skyrocketing profits, workers have not shared in the largesse. In addition, global product supply shortages and shipping issues caused by the COVID-19 pandemic continue to disrupt the supply of goods and services, resulting in higher consumer pricesvii that put an additional strain on households already living paycheck to paycheck. In July, nearly 40% of Missouri households had difficulty paying for usual household expenses, up from nearly 25% the previous year.viii

Wages in Perspective: Minimum Wage Not Enough to Make Ends Meet

Missouri’s current minimum wage is $11.15 per hour. In 2018, voters approved annual minimum wage increases until 2023, when the wage will be $12 per hour. However, that is still only about half of what a working family of four needs to cover basic living expenses, according to the Massachusetts Institute of Technology Living Wage Calculator for Missouri.

Gender, Racial, and Occupational Disparities in Earnings

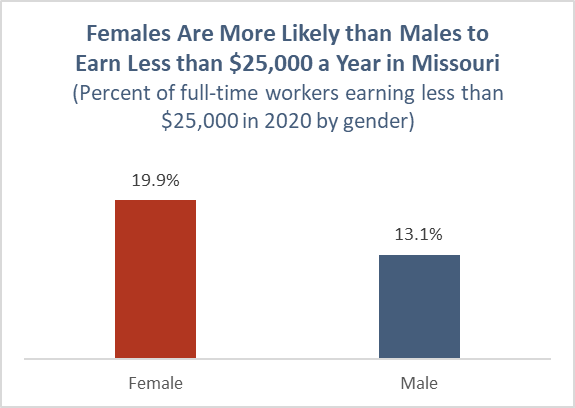

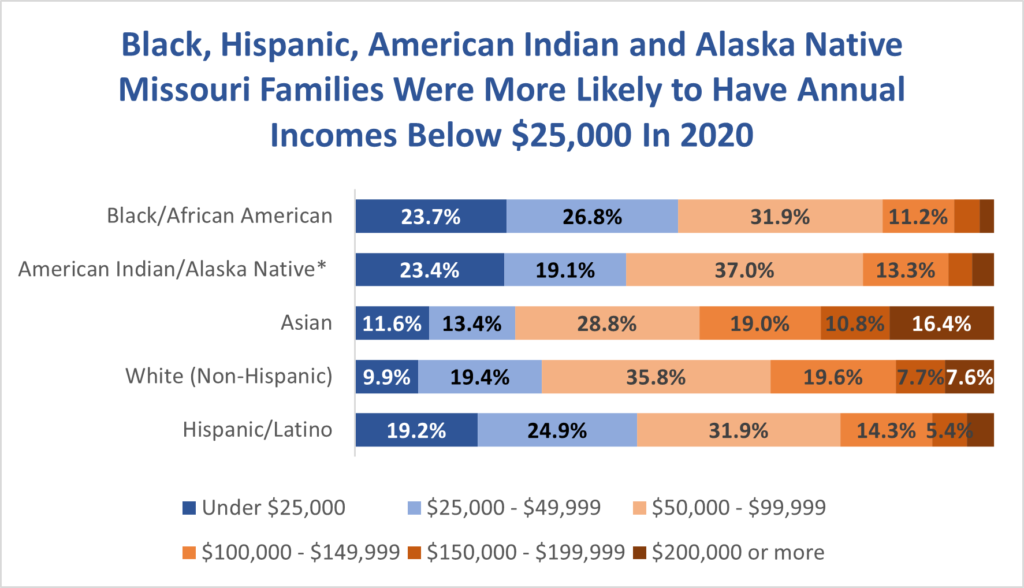

Overall wage metrics do not capture significant differences in the pay of men and women, or of workers by race. Specifically, women and workers of color are more likely to earn less than $25,000 compared to men or white workers as a whole.

Notes: All race categories are single race. All other races, except for White (non-Hispanic), do not distinguish between Hispanic and non-Hispanic ethnicity. Hispanic/Latino may be of any race. Family income includes all forms of income received on a regular basis, such wages, social security, public assistance, etc.

Source: MBP analysis of data from U.S. Census Bureau, 2016-2020 American Community Survey 5-Year Estimates, Family Income In the Past 12 Months (In 2020 Inflation-Adjusted Dollars), Tables B19101B-D and B19101H-I.

Low Wages Often Go Hand in Hand With Lack of

Other Measures of Job Stability

Workers earning low wages are far more likely to have unstable jobs with unpredictable schedules and involuntary part-time work, compared to higher wage earners. Low paying jobs also tend to offer fewer benefits (e.g., healthcare insurance, paid leave, etc.).

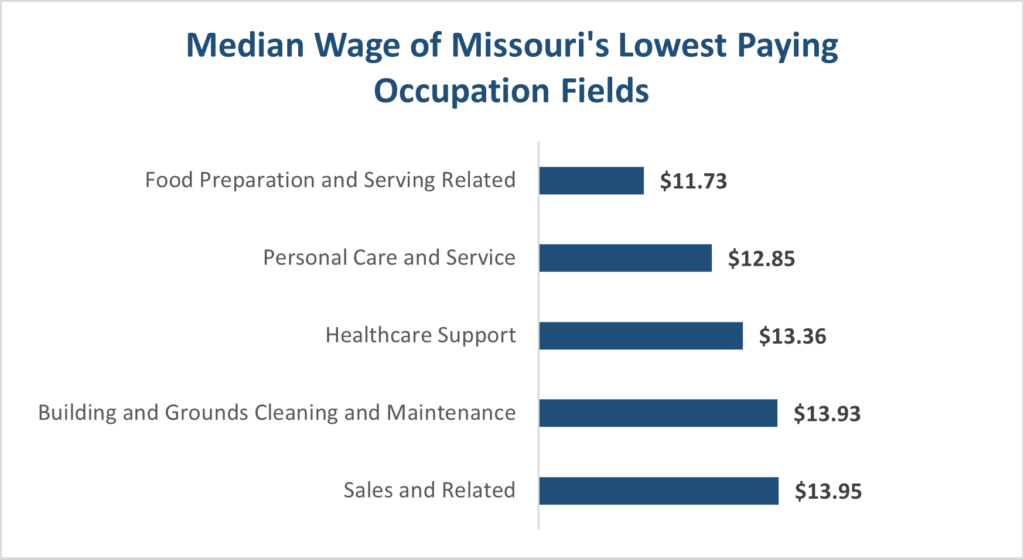

This lack of financial and economic stability makes it difficult for low wage workers to weather economic downturns and save for unexpected emergencies. Notably, most of Missouri’s lowest paid workers work in industries that experienced the greatest job loss during the pandemic.

Moreover, food service workers, childcare workers, and home health aides – critical workers who were deemed essential during the pandemic – all have median wages below $12 per hour.

“Raising the minimum wage would be life-changing. It would help me tremendously. I wouldn’t have to rely on government assistance to take care of me and my kids. I would be able to get my own place, as well as have a dependable working car. I’d be able to give my kids the lifestyle they deserve.”

Nicole Rush, Restaurant Employee

Next: A Spotlight on Care Workers

Page 1: Introduction

Page 2: Wages

Page 3: A Spotlight on Care Workers

Page 4: Jobs & Unemployment

Page 5: Conclusion