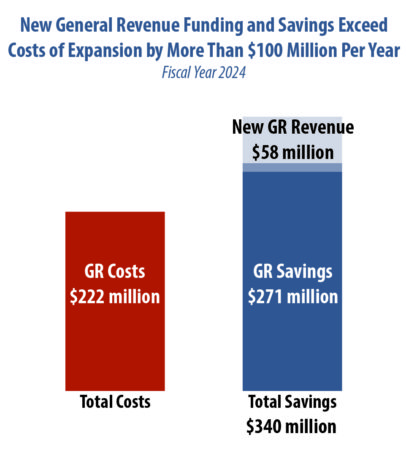

While counterintuitive, Medicaid expansion would result in more than $100 million in state general revenue savings and new revenue for the state of Missouri. This net increase in the general revenue budget would make funds available that could be used for other priorities, including education.

These dynamics, which have been documented in other states, occur because under Medicaid expansion, the federal government would pay 90 percent of the cost for a variety of health services that are currently funded by state general revenue tax dollars. Additionally, the infusion of federal funds from expansion would result in increased state income and sales tax revenue. Combined, these funds would surpass the state’s contribution toward expansion and result in net savings in state general revenue.

Expansion’s Higher Federal Match Rate Provides the Basis for State Savings

Medicaid is a partnership between the federal and state government. In Missouri, the federal government provides about 65 percent of funds to support Medicaid services, and the state provides about 35 percent.

However, Medicaid expansion populations will be covered at a much higher 90 percent federal match rate, with the state responsible for only 10 percent of the cost of expansion.

Moreover, this is a permanent match rate. Since the creation of Medicaid in 1965, the federal government has never reduced a permanent match rate.

Leveraging an Increased Federal Match

Medicaid expansion would provide major state savings because Missouri could leverage the higher 90 percent federal match rate for services already being provided using the current 65 percent federal match rate. Missourians would receive the same care under the same program – but at less cost to the state general revenue budget.

Two examples of how this manifests itself in an expanded Medicaid environment would be payment for pregnancies and disabled but non- dual eligible Medicaid recipients (“dual eligible refers to those eligible for both Medicare and Medicaid).

Today a woman who becomes pregnant and is in- come-eligible would have her health care costs paid by Medicaid under a 65/35 cost share.

If Medicaid is expanded, women under 138% FPL would be covered under the “newly eligible” category, and the cost of her care would be covered under the 90/10 cost-share.

This enhanced match rate would cover more than 20,000 pregnancies, saving Missouri over $50 million in general revenue.

Participants in Medicaid who have received a disability determination from the state but have not gone on to Medicare would be covered as a “newly eligible.”

It is anticipated that a significant number will forgo a disability determination and choose the “newly eligible” pathway instead.

Moving to a 90 percent federal match could save Missouri well over $150 million dollars a year.

Similar financial savings apply to other categories of eligibility as well, as shown in Table 1.

All told, Missouri could see savings of more than $235 million by leveraging a higher federal match rate.

Drawing a Federal Match for Services Currently Funded Only By the State

Additionally, some health services currently paid for entirely by the state would be eligible for a 90 percent federal match under Medicaid expansion:

MO HealthNet covers some blind Missourians using entirely state funds. As they move into an expansion category, Missouri would save over $1

million in general revenue.

Similarly, the state is already required to provide medical care to prisoners in the custody of the Missouri Department of Corrections. The total cost of these services is paid with state funds.

Under expansion, Medicaid would pay for inpatient hospital visits with the federal government picking up 90 percent of the cost, saving $3.4 million in general revenue.

Savings from drawing a federal match for services currently paid entirely with state dollars would exceed $35 million.

Expansion Spurs New State Tax Revenue

In addition to cost savings, the influx of federal funding to support Medicaid expansion would generate new state tax revenue.

Missouri is expected to receive over $2.5 billion in new federal funding to support Medicaid expansion. These funds would flow directly into the health care industry and generate additional state income and sales tax revenue.

(These estimates do not use economic multipliers or contain increases in economic activity outside the expenditures of the new federal funds.)

It is estimated that Missouri would see over $50 million in new income & sales tax revenue as a result of these funds.

States That Have Already Expanded Medicaid Show Similar Savings

Kaiser Family Foundation recently issued a report entitled The Effects of Medicaid Expansion under the ACA: Updated Findings from a Literature Review. This report, which collected data from 324 studies conducted on the impact of Medicaid expansion, demonstrated several positive outcomes. These outcomes include improved financial security for working families who have low wages; increased access to care and use of preventive services; reductions in uncompensated care costs at hospitals and clinics; improved health outcomes for new participants; gains in state employment; and one study concluded it that Medicaid expansion resulted in lowered premiums in the private market.

- The focus of this paper are the findings related to the impact of expansion on state budgets, which have been significant, as shown in the following examples:

- A review of studies in five states that expanded Medicaid (Michigan, Montana, Virginia, Louisiana and Colorado) showed that in each of the states, expansion either saved general revenue funds or did not result in general revenue costs.

- A Louisiana annual report showed that expansion saved the state $199 million in FY 2017 due to multiple factors, including the higher federal match rate for Medicaid populations that were previously funded at the regular state match rate.

- Another study by the Louisiana Department of Health found FY2017 that its Medicaid expansion created an additional $103.2 million in overall state tax receipts (which exceeded the state dollars budgeted for the Medicaid expansion program by close to $50 million) and local governments saw an additional $74.6 million in local tax receipts.

- Virginia’s budget estimated $421 million in state budget savings that were allocated to other budget priorities like education.

- In Michigan, a study published in the New England Journal of Medicine indicated that added economic activity from expansion would yield $145 million to $153 million in state tax revenue each year.

- An analysis in Montana reported that state costs for expansion were offset by savings that expansion created and new revenue resulting from increased economic activity.

- A Colorado analysis found that increased income, sales, and use taxes resulting from expansion totaled more than $100 million in fiscal year 2016 and would exceed $150 million by fiscal year 2025.