Governor Parson’s recently released tax proposal would leave out about 1/3 of Missourians, including many of those who pay the highest proportion of their income in state & local taxes, and set the state up for a Kansas-like budget bomb that would require significant cuts to schools, public safety, healthcare, and other critical needs. By eliminating an expensive tax loophole and strengthening certain tax credits, lawmakers can still reduce the top rate of income tax AND ensure that it reaches every Missourian – while protecting funding for schools, public safety, health, and the other critical services that we all rely on.

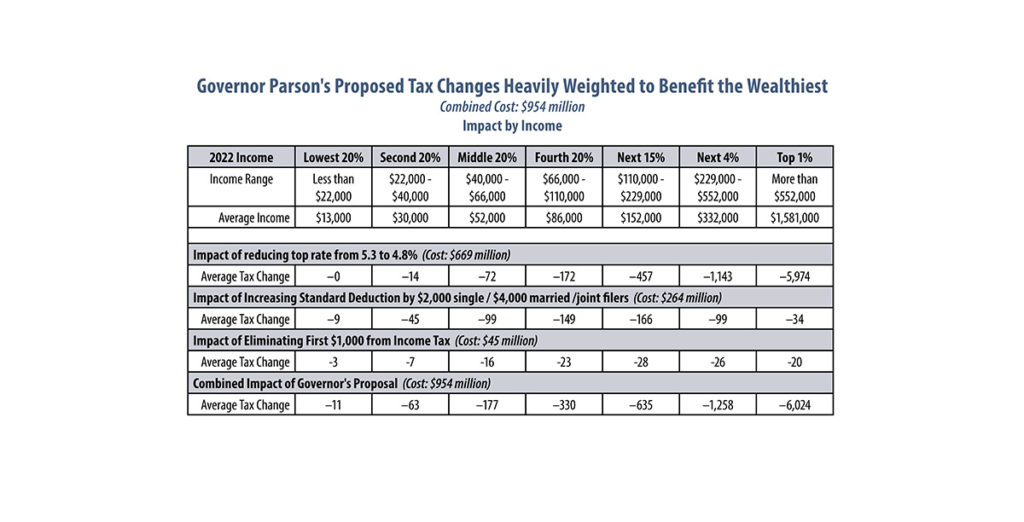

Governor’s Proposal Leaves Out 1/3 of Missourians, Favors the Wealthiest, and Jeopardizes Public Services

In addition to several agricultural tax credits, Governor Parson’s tax proposal would reduce the top rate of income tax from the current 5.3% to 4.8%, increase the standard deduction by $2,000 for single filers and $4,000 for joint filers, and eliminate the first tax bracket – essentially exempting the first $1,000 of income from tax.

The income tax changes alone would reduce state general revenue by over $950 million in the first full tax year of implementation.

- In context, that amount is nearly 27% of the total state funding formula for local schools.

- This decrease in state general revenue coupled with the loss of one-time federal funds would make it extremely difficult for lawmakers to fully fund schools, public safety, healthcare, and other critical needs.

Further, the proposal is heavily weighted to benefit the wealthiest Missourians and leaves out 33% of Missouri taxpayers entirely.

- Older Missourians living on fixed incomes and low wage families with children would see no tax change.

- Moreover, for those who do get a cut, the wealthiest 1% of Missourians would receive $6,024 on average, while the lowest income Missourians would receive just $11.

- The policies would do little to address recent increases in property taxes or higher sales taxes resulting from inflation, both of which have had disproportionate impacts on working families and seniors with fixed incomes.

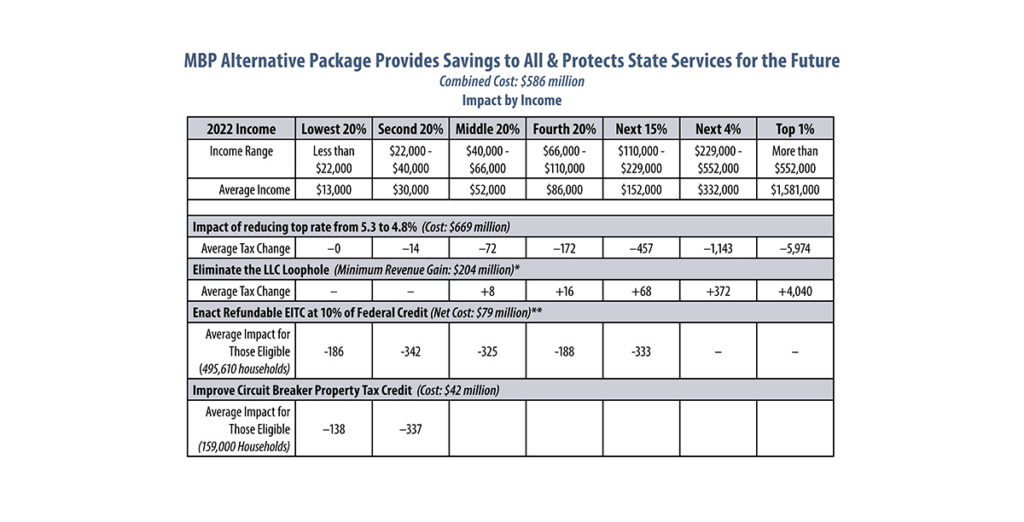

An Alternate Proposal That Benefits Every Missourian

Instead, lawmakers could enact an alternative proposal that would reach every Missourian, make Missouri’s tax code fairer and protect funding for schools, public safety, health, and the many other critical services that all Missourians rely on.

Specifically, the plan would:

- Reduce the top rate of income tax from the current 5.3% to 4.8%.

- Eliminate the flawed business income deduction, otherwise known as the “LLC Loophole” or “pass-through” deduction.

- Strengthen Missouri’s Working Families Credit and Circuit Breaker Tax Credit to reach the Missourians left behind in the Governor’s proposal.

The alternate proposal would allow lawmakers to provide a tax cut to every Missourian – but in a fiscally prudent way, at a sustainable cost of $586 million per tax year. While Missouri is fortunate to have the budget reserves it currently does, this situation is temporary, and is a result of short term federal funds. Quite simply, relying on the current surplus to fund permanent tax changes isn’t fiscally sustainable, or responsible, and will ultimately require cuts to state services like we saw in Kansas a few years ago.

This would occur because Missouri’s current rosy budget picture is a result of both responsible budgeting AND federal dollars, and is likely temporary.

- In response to COVID, the federal government provided billions of dollars to Missouri families and businesses, which bolstered the state’s economy and consumer spending – and therefore state revenue collections.

- Moreover, extraordinary federal funds sent to the state treasury allowed the state to stockpile a large amount of general revenue.

- These dynamics largely contributed to a temporary state budget surplus. Governor Parson was reluctant to use short term federal funds for ongoing needs, and the same logic applies here.

Alternative Makes State Tax Structure Fairer, Provides Fiscally Responsible Tax Relief for Every Missourian

Missouri’s tax structure should be fair, balanced, and able to support schools, public safety, health care and the other critical public services that provide the foundation for all Missourians to thrive.

The following changes to Missouri’s tax code are based on those principles.

Eliminating the Business Income Deduction

Missouri’s business income deduction was enacted in 2014 and effectively provides a tax cut for a select group of businesses, including LLCs (limited liability companies), S-corporations, Partnerships and Sole Proprietorships that file their taxes through the individual income tax structure. For that

select group, 20% of their income will be exempt from tax when the change is fully implemented, while other Missouri companies would continue to pay state tax on the majority of their income. As a result, the exemption creates an incentive for businesses to change their corporate structure in order to avoid paying state tax. This exemption is known as the LLC Loophole.

A similar provision was included in the Kansas tax cuts enacted in 2012. While the LLC exemption likely resulted in the growth of registered LLCs, it did not spur economic or job growth.

- Tax analysts across the political spectrum agree that this provision does nothing to stimulate the economy, but simply encourages tax avoidance by giving certain businesses an unfair tax advantage.

- As the Tax Foundation notes: “There is no sound economic justification for treating two types of business activity so dramatically differently.”

- The Kansas legislature reversed its tax cuts in 2017 after enacting nine rounds of budget cuts, accruing record-high levels of debt, and seeing three downgrades in the state’s credit rating.

Eliminating this deduction would strengthen the fairness of Missouri’s tax code and help offset the cost of the income tax rate reduction. LLCs and others who would have benefited from the business income deduction would still receive the same or larger tax reduction through the cut in the top rate of income tax.

Improving the Working Families & Circuit Breaker Tax Credits

Although Governor Parson has indicated he intends to provide tax savings to all Missourians, about one-third of Missourians would be left out of his plan.

- Older Missourians who rely solely on social security income, retired teachers who depend on state pensions, and working families with low-wages may earn too little money to owe income taxes, but they contribute significant portions of their income to state general revenue in sales and property taxes.

- In fact, in Missouri, the lower your earnings, the more you pay in state and local taxes as a share of what you make: according to the most recent analysis, Missouri families in the bottom quintile of income pay 9.9% of their income in state and local taxes, compared to just 6.2% for the wealthiest 1% of families.

Strengthen the Working Families Tax Credit

Missouri lawmakers approved a Working Families Credit that has not yet been implemented and is limited based on income tax liability. As a result, it will not offset the considerable increases in sales tax that families are facing.

Making the credit refundable will not only reach more working families, but also unleash its full impact.

- Research has documented that while most families receive the similar federal Earned Income Tax Credit (EITC) only temporarily, it has profound long-term benefits for families and communities.

- Children whose families receive the federal EITC are healthier, do better and go farther in school, and enjoy greater earnings as adults, establishing a more productive and skilled workforce for Missouri’s future.

- Refundable state credits build on that success and contribute to child welfare. In fact, states with refundable credits have seen marked reductions in the rates of child maltreatment and reduced foster care entries compared to states without an EITC.

- Missouri’s current credit will reach an estimated 250,000 families.

- A refundable credit would reach 495,610 working families.

Enhance the Circuit Breaker Tax Credit

Missouri currently exempts from income tax Social Security income for seniors with adjusted gross incomes up to $85,000 (for single filers) and $100,000 (for joint filers). This means that older Missourians who rely solely on social security income, and many retired teachers and others who rely solely on state pension plans, are exempt from state income tax. Because of this, these folks will not benefit from the proposed income tax rate cut.

Yet, at the same time, older Missourians with fixed incomes are facing significant tax increases due to increases in property taxes and higher sales taxes resulting from inflation. Strengthening Missouri’s Circuit Breaker Tax Credit could help offset these increases for older Missourians and help seniors and Missourians with disabilities who have fixed incomes remain in their own homes.

Currently, the income eligibility limits & benefit amounts for the Circuit Breaker are fixed and do not automatically adjust for inflation.

- As a result, fewer Missourians qualify for a smaller credit over time – despite increasing property tax costs.

- Income eligibility caps range from $27,500 for single renters to $34,000 for married homeowners. While Missouri’s Circuit Breaker is a lifeline for many older adults and people living with disabilities, only very low-income recipients (those with incomes below $14,300) qualify for the maximum credit.

- The size of the tax credit phases out quickly so that those near the income eligibility cap receive credits of less than $10 annually.

Further, although property taxes increase annually, the size of Missouri’s circuit breaker credit is flat and is not tied to any annual increase. Moreover, Missouri’s income guidelines are not indexed against inflation, meaning that while average incomes increase over time, Missouri’s eligibility guidelines do not change.

As a result, fewer people qualify for the credit over time and those that do are more likely to fall higher on the phase-out scale – meaning they qualify to receive a smaller credit.

Missouri can strengthen and improve its existing Circuit Breaker tax credit by increasing the size of credits available to current recipients and by expanding eligibility for the credit to more low-income Missourians.