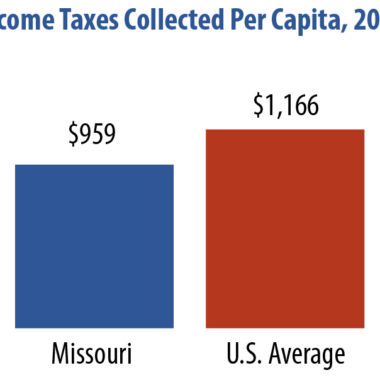

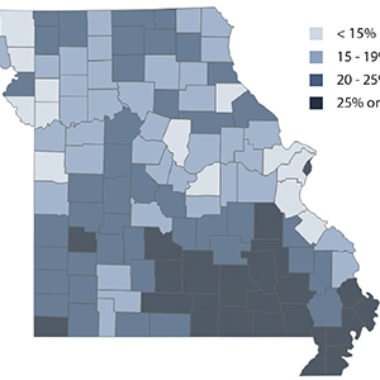

How Missouri’s Taxes Compare

A variety of revenue sources contribute to the state public services Missourians rely on as a foundation to build their lives. In addition to federal funds, sources include income and sales taxes, gas and tobacco taxes, and lottery and gaming revenue. This diversity of funding Read More