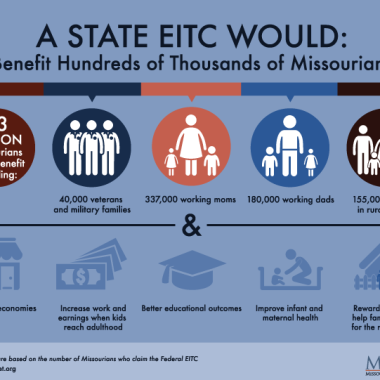

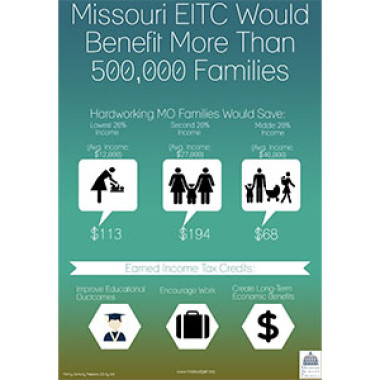

State EITC: Reduce Poverty, Boost Local Economies,& Encourage Work

A prosperous Missouri requires a strong middle class, with the ability for families that work hard to achieve a better future. A state Earned Income Tax Credit (EITC) is one of the best ways Missouri can help all working families – even those in low-paying jobs — have the Read More