New Census Data Underscores Need for Missouri Earned Income Tax Credit

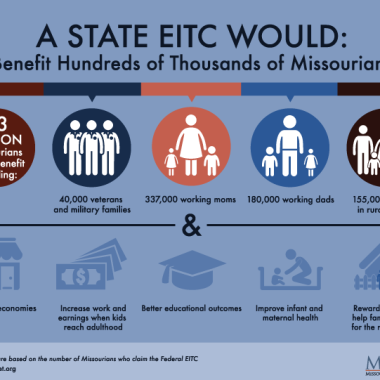

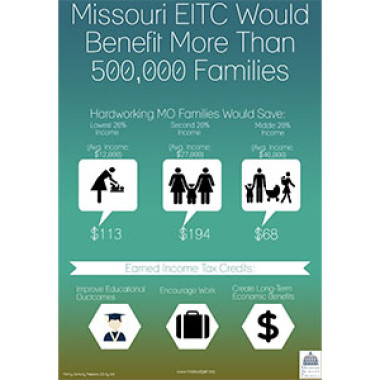

Statement from Amy Blouin, Missouri Budget Project Executive Director More than one in five Missouri kids are growing up in families that can’t afford the basics necessary for a good start to life because they make so little. Although poverty slightly declined since the previous Read More