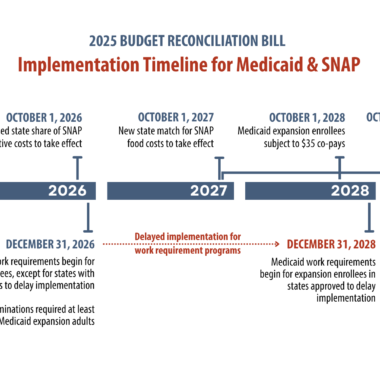

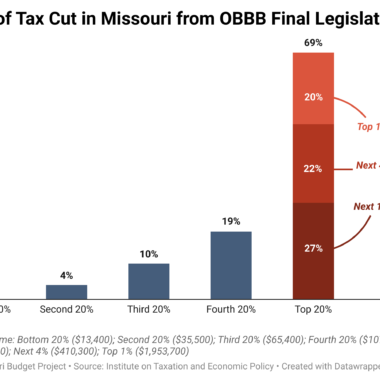

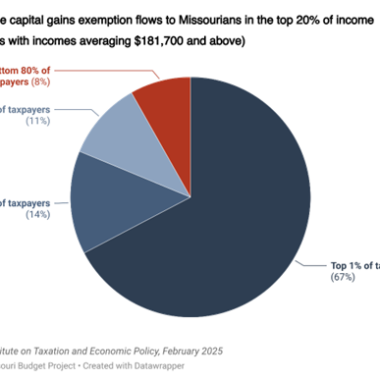

What’s at Risk: Medicaid & SNAP in Missouri

References Include: Analysis of coverage losses from Missouri Foundation for Health, 2025 Joseph Llobrera, Dottie Rosenbaum, and Catlin Nchako, “Senate Agriculture Committee’s Revised Work Requirement Would Risk Taking Away Food Assistance From More Than 5 Million People: Read More