A variety of revenue sources contribute to the state public services Missourians rely on as a foundation to build their lives. In addition to federal funds, sources include income and sales taxes, gas and tobacco taxes, and lottery and gaming revenue. This diversity of funding sources provides more stability to the state’s budget, making Missouri less vulnerable to shortfalls that result from short-term economic changes.

Compared to Other States, Missouri:

Earmarks more state-generated funds for specific purposes.

- So, while state general revenue may appear heavily reliant on income tax, it makes up just 32% of all state-based revenue sources.

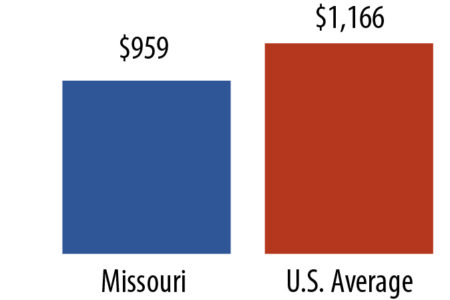

Missouri’s reliance on individual income tax is in-line with the nation, at just $959 per capita compared to the national average of $1,166.

Missouri’s Income Tax Rates Already Declining – Already

Pending Changes Will Cost More Than $670 Million Annually

Between 2014 and 2021, lawmakers approved multiple changes to the state income tax. Taken together they:

- Decreased the corporate income tax rate from 6.25 to 4 percent,

- Created a 20% business income deduction for LLCs and other pass-through entities, and

- Reduced the top rate of individual income tax from 6 to 4.8 percent.

The change to the top rate of individual income tax is being phased in over several years, depending on revenue targets being met. Missouri has already dropped the top rate from 6% to 5.3%, but several steps remain.

Not including other provisions such as the LLC exemption, the remaining reductions in the top rate of individual income tax alone will reduce state general revenue by $669 million per year when fully implemented.

Missouri’s Top Rate of Individual Income Tax Rate is Already Less Than Average

At 5.3%, Missouri’s top individual income tax rate is currently lower than 28 other states, including our neighbor states of Arkansas, Iowa, Kansas — and well below the national average of 6.4%.

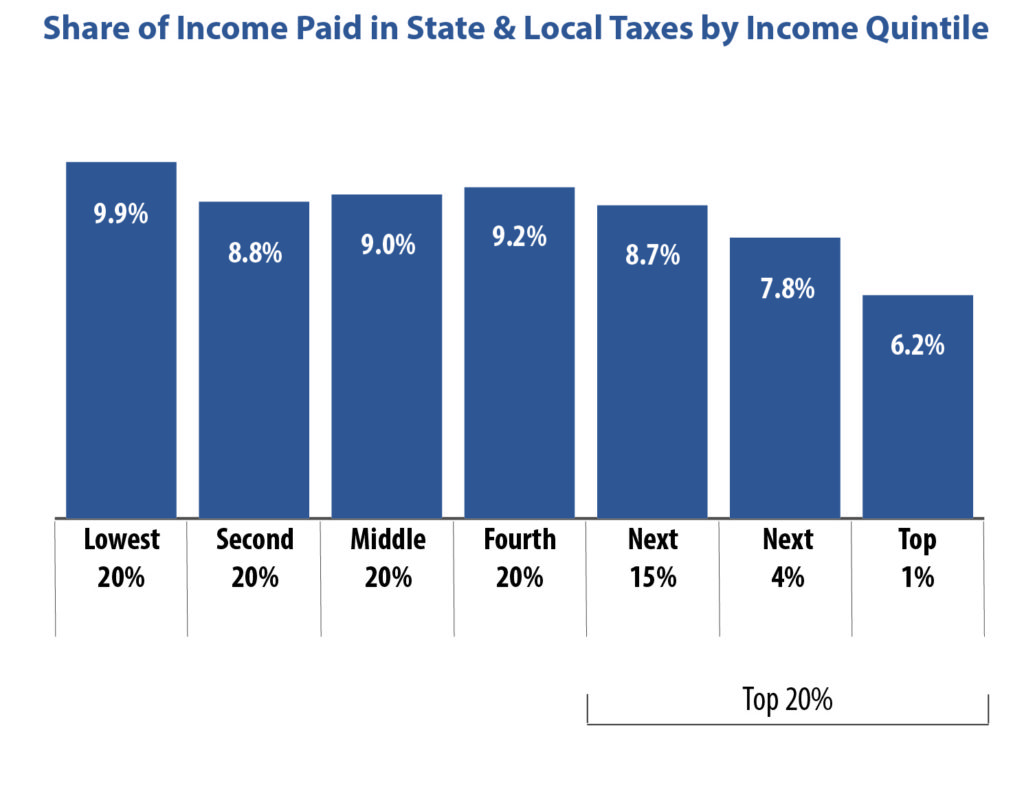

Lower Income Missourians Pay a Higher Share of Their Income in State & Local Taxes Than Wealthiest

Missouri’s overall tax structure is regressive, which means the more income you earn, the less you pay in taxes as a percent of that income.

- While changes to the state income tax over the last decade have disproportionately benefited the wealthiest Missourians, significant increases in local sales taxes have had the opposite impact for Missourians with lower incomes.

- When state tax reductions took effect, state revenue to fund services became more limited. Attempting to make up the difference, localities increased local sales tax rates and created multiple taxing jurisdictions resulting in “stacking” of sales tax.

- As a result, the average state and local sales tax in Missouri is now 8.29%, well above the national average of 6.57%.

Overall, the decreases in the top rate of income tax combined with higher sales taxes have made Missouri’s tax structure more regressive.

Missouri working families and Missourians with fixed incomes pay a much larger share of their income to support public services than wealthy Missourians.