A number of tax changes made over the last decade have resulted in an inadequate, upside-down tax system that shifts the costs to hardworking Missouri families while the wealthy and out-of-state corporations pay less than their fair share for public services, depriving our state of the revenue needed to support thriving communities in Missouri.

These changes to the tax system have real consequences for real people. Our state tax revenue helps pay for teacher salaries, supports adoptive and foster care families so that kids can grow in safe and loving environments, increases access to mental health services for those that need them, and provides for safe and thriving communities. But Missouri’s investments in its citizens have now fallen well behind – both as compared to other states and where we were in prior years.

Missouri Invests Less in Its Residents Than It Did in 2000

Although the size of the state budget has grown nominally over time, simply looking at the number of dollars in revenue year-to-year fails to account for inflation, population growth, and economic growth.

To compare investments in services over time, we use inflation-adjusted measures to compare general revenue spending per person over time. This allows for “apples to apples” comparisons of spending on services over time.

Missouri spent less general revenue per person in fiscal year 2023 than it did in fiscal year 2000.

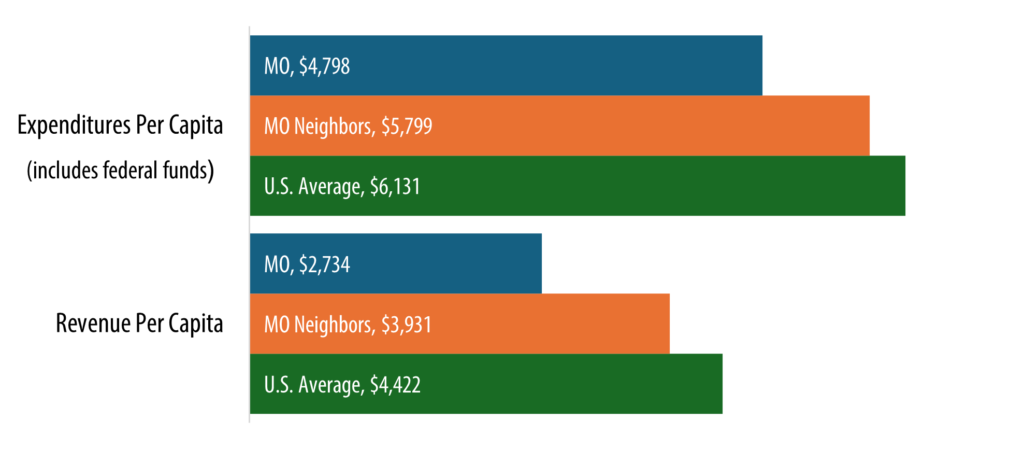

As a result, only four states in the nation collect less state revenue per capita than Missouri.

Federal funds also help pay for state services. But even when both state and federal funds are included, only six states spend less per capita on services for their residents.

Among all states, Missouri is ranked:

46th in the amount of state revenue it collects per person

44th in the amount it spends per person (including federal funds)

This trend holds closer to home as well. Compared to its eight neighboring states, Missouri collects the least state revenue per capita, and ranks next to last in spending.

Missouri has consistently ranked near the bottom of these metrics for years.

State Disinvestment Erodes Services for Missourians

Over the last few years, extraordinary federal funding related to the pandemic has temporarily bolstered our state’s ability to invest in the services our communities need, while masking the true impact of Missouri’s tax cuts. As enhanced federal funds expire and run out and additional state tax cuts go into effect, the revenue our state has to invest in public services will decline even further.

This means Missouri is about to hit a budget cliff – at a time when the state’s investment in critical services is already inadequate and falling behind.

The following examples illustrate the impact of Missouri’s disinvestment in a range of services that impact Missourians from the cradle to the grave.

K-12 Education

Quality education is a hallmark of safe and vibrant communities, contributing to the long-term health, economic stability, and wellbeing of our children, our local communities, and our state.

However, Missouri’s per student spending for local schools lags far behind most other states.

Missouri spends $14,000 per student – and nearly $3,500 per student less than the national average of $17,500. 75% of all states spend more educating their children.

Missouri’s share of funding K-12 funding provided by the state (27.8%) is lower than every other state in the nation.

Missouri’s low state funding means that school districts must fill gaps with local funding.

But high poverty districts that need the most resources to educate students have the least ability to fill gaps in funding with local resources.

This means that Missouri’s highest poverty districts receive $2,888 (or 19%) less funding per student than more affluent districts.

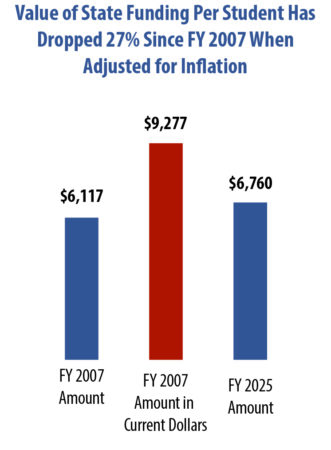

Missouri’s state funding is determined by the State Adequacy Target (SAT), which sets a minimum amount of state funding per student.

However, the SAT has failed to keep pace with inflation, meaning Missouri now invests significantly less than in prior years.

While lawmakers recently passed legislation that increases this funding, stagnant revenue caused by recent tax cuts calls into question Missouri’s ability to fully fund those increases.

When adjusted for inflation, Missouri’s SAT is over $2,500 lower than in 2007.

Child Care

High-quality, affordable child care not only lays a solid foundation for children to thrive, but it is also an essential component of a strong economy, allowing parents to fully and actively participate in the workforce, provide for their families, and drive economic growth.

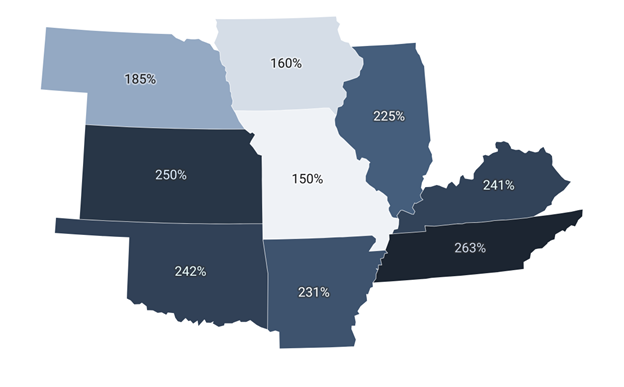

Missouri’s child care subsidy program provides assistance to low-income Missourians to offset child care costs. However, Missouri has one of the lowest eligibility thresholds in the country – there are only three states that have a lower threshold to receive a full subsidy, and all of the eight states that border Missouri have higher eligibility thresholds.

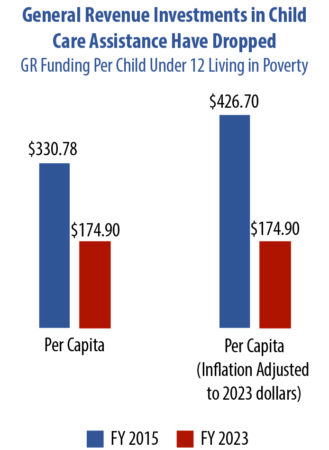

Further, over the past decade, the amount of state funding invested in child care assistance has declined dramatically.

While Missouri has recently made several much needed improvements to child care assistance programs, it has done so largely by filling gaps in state funding with temporary federal dollars designed to enhance childcare assistance during the pandemic. As those federal funds run out, Missouri will need to identify additional resources from existing state and federal sources to maintain services at the current level.

Community-Based Supports for Older Adults and People with Disabilities

As Missourians live longer, both the number and share of older adults in our state has increased.

While most of these Missourians will continue to live independently, many will require support to live at home for as long as they choose and to continue to fully participate in and contribute to their communities.

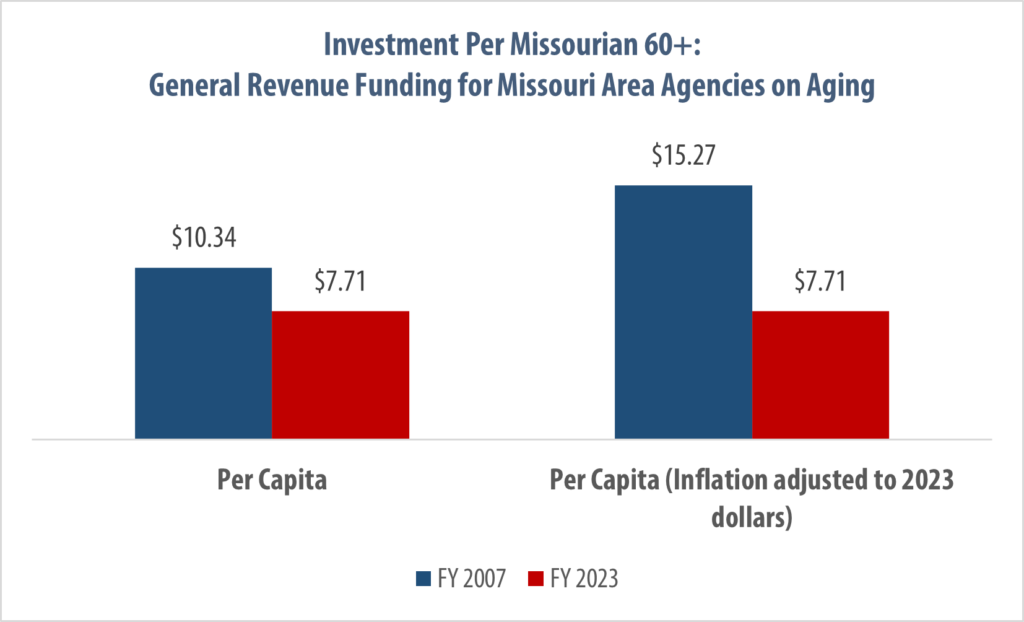

Missouri’s Area Agencies on Aging (AAAs) provide critical services, such as home-based care and meal delivery that are designed to support older adults who live in the community. But funding for these “wraparound” services is both low and stagnant. Missouri’s AAAs receive only around 11% of their funding from state general revenue, a lower share than most other states in the nation and around half the national average of 21%.

Without wraparound supports, many older Missourians would not be able to stay in their homes and communities. This has the potential to push Missourians into more costly institutional care, ultimately raising costs to the state. In fact, around one in four nursing home residents in Missouri have low care needs, a rate higher than every other state in the nation and well above the national average of 8.8%.

Higher Education

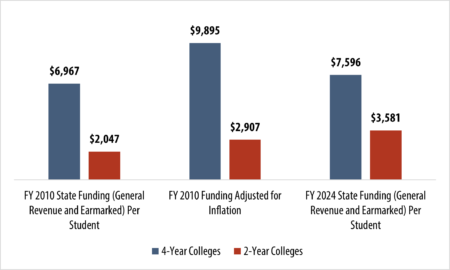

Higher education is a critical component in developing a skilled and educated workforce that contributes to a better economy and shared prosperity for all Missourians. Unfortunately, Missouri’s investments in higher education have remained stagnant, failing to keep pace with inflation and falling well below the per capita investments of most other states.

In 2024, only four states invested less per capita in higher education than Missouri.

Missouri’s per capita investment of $207 was lower than all our neighboring states, and well below the national average of $378.

State investments in two-year colleges have increased slightly when accounting for inflation, but funding for Missouri’s four-year institutions has not kept pace with inflation.

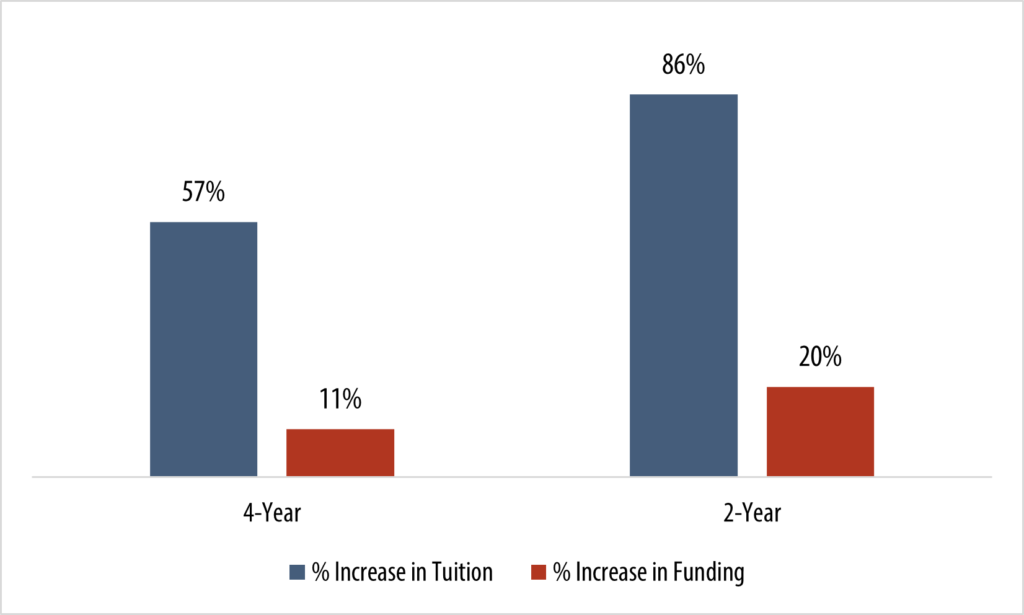

At the same time state funding for higher education has stagnated, costs for families have gone up. Since 2010, tuition increases have significantly outpaced state investments.

Summary

Over the next few years, the remaining implementation of tax cuts will continue to limit Missouri’s ability to invest in the building blocks of a sound economy. Every year, our state will have fewer resources for the public services that help Missourians reach their full potential than it once did, despite Missouri already being behind our neighbor states.

Missouri’s tax system and state budget are the products of policy CHOICES made by our state’s elected officials. This means we can make better choices in the future that invest in Missourians and ensure that everyone pays their fair share. This will set Missouri up for a future that provides greater opportunity for all of us, both rural and urban, and within every community, no matter the zip code.