The Truth About States Without Income Taxes

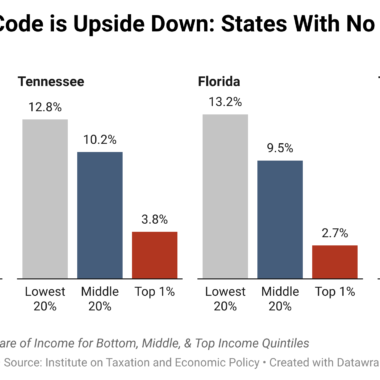

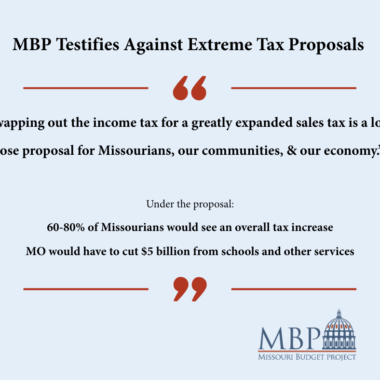

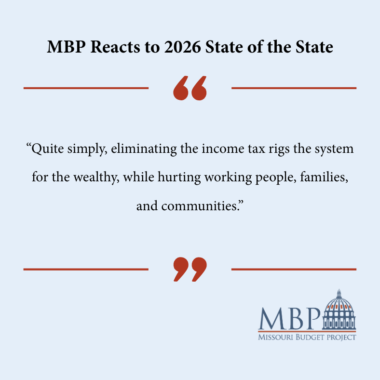

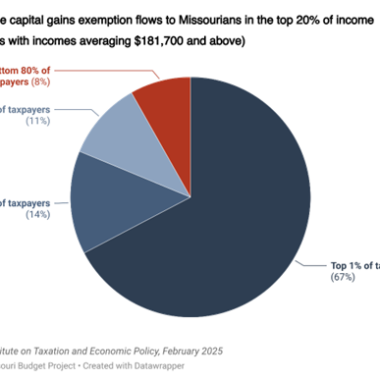

Some Missouri lawmakers want to eliminate the state’s income tax and greatly expand sales taxes, pointing to states like Tennessee, Florida, & Texas as models. But those states have resources Missouri does not have, and except for the highest earners, taxpayers in those Read More