Contrary to the extraordinary growth of general revenue in recent years, state revenue is stagnating, which will result in difficult budget decisions in future years. The fluctuations in state revenue are a result of overlapping factors. Specifically, federal COVID funding has boosted the state’s budget and allowed it to spend more than it is collecting, masking the impact of tax cuts that are currently being implemented.

Federal Funds Drove Growth, State General Revenue Now Flatlining

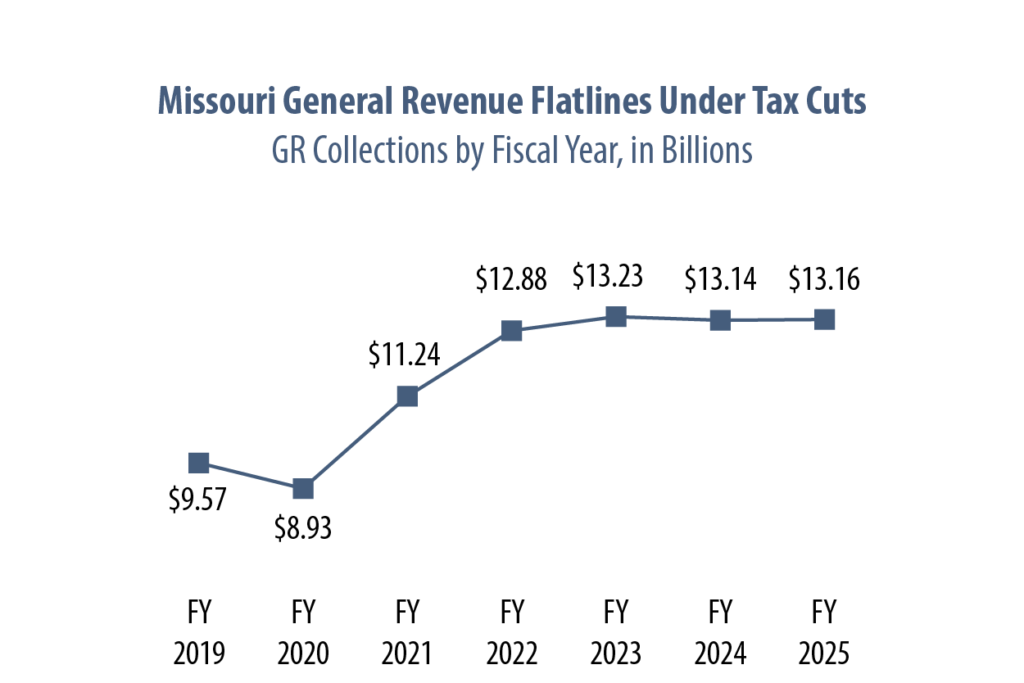

Estimates of expected state general revenue for the current and next state budget years indicate that state general revenue is bottoming out.

- The revised estimate for the current fiscal year (FY2024) assumes $13.14 billion in net general revenue collections – a 0.7 percent decline compared to FY23.

- Net general revenue collections for Fiscal Year 2025 (the budget year that begins on July 1, 2024) are expected to be $13.16 billion. This represents a 0.2 percent net general revenue growth over the revised revenue estimate for FY24.

The stagnation of state general revenue may surprise policymakers and the public alike because it comes on the heels of several years of exceptional

revenue growth. In fact, state general revenue grew from $9.567 billion in FY 2019 (prior to COVID) to an estimated $13.14 billion in the current year –

or by 37 percent over five years.

This growth was driven largely by an infusion of federal COVID relief that provided significant financial assistance to states and localities, companies

and nonprofit organizations and individuals. That assistance temporarily bolstered the state’s economy and state tax revenue. However, those extraordinary funds – and the associated growth – were temporary. As the state transitions from the COVID era, those federal resources are dwindling.

Federal COVID Dollars Have Masked the Cost of State Tax Cuts

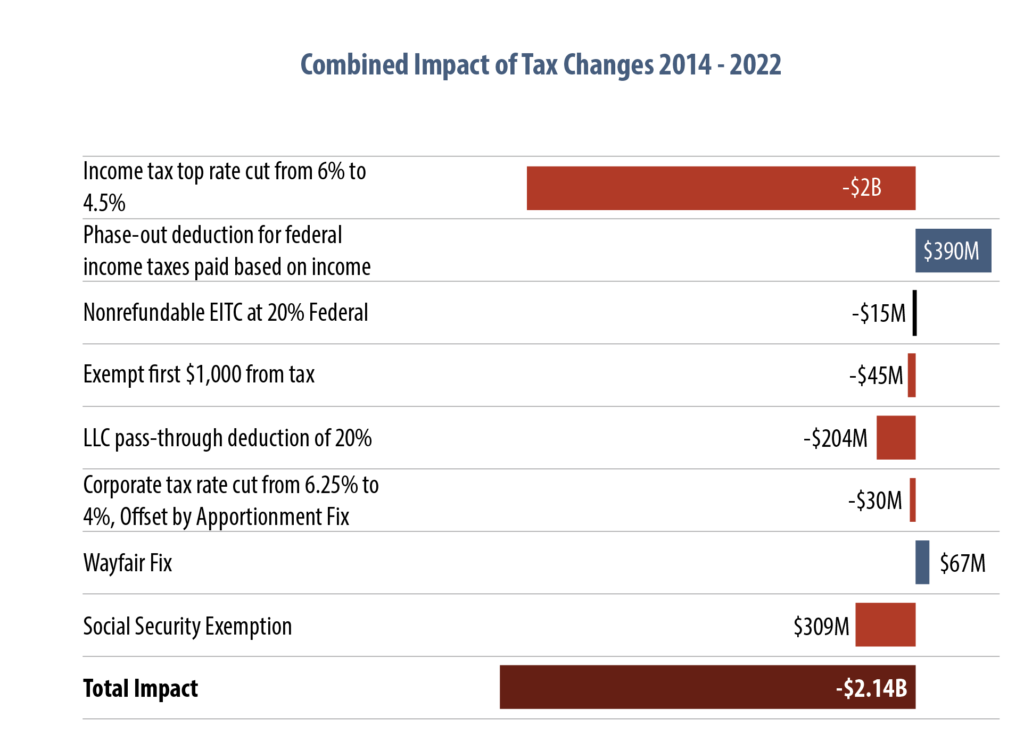

State lawmakers approved a series of sizeable state tax cuts that are taking a bite out of state general revenue – at the same time as Missouri’s COVID

resources are dwindling. The one-two punch is creating the flatlining of state revenue that is occurring today. However, the implementation of

Missouri’s state tax reductions is ongoing. When fully implemented, the cuts will reduce state general revenue by $2.14 billion per year, an amount that exceeds the amount of state general revenue provided through the foundation formula to local public schools.

However, federal COVID funds continue to disguise the upcoming reductions in state revenue as a result of general revenue “savings” that have amassed in recent years. With the infusion of federal COVID funds, Missouri was able to use federal dollars in place of state revenue throughout the budget. As a result, the state was able to amass general revenue savings during COVID years – accruing $4.3 billion in general revenue “savings” between fiscal year 2019 and fiscal

year 2023.

These savings have temporarily offset the impact of the tax cuts on the budget. In fact, in the current budget year, the State General Revenue Budget of $15.2 billion is more than $2 billion larger than the amount of general revenue that the state is expected to collect.

The general revenue savings accrued during COVID are essentially being used to offset the holes in the budget stemming from the tax cuts. As those savings dissipate, the impact of the tax reductions will become much more difficult to manage.

Ongoing Implementation of Tax Cuts

Tax cuts will continue to limit Missouri’s ability to invest in the building blocks of a sound economy. Every year, our state will have fewer resources for the public services that help Missourians reach their full potential than it once did, despite Missouri already being behind our neighbor states.

2021 Per Capita State Tax Revenue

(Missouri & Neighboring States)

2021 Per Capita State Expenditures,

including State and Federal Funds (Missouri & Neighboring States)

| National Rank | State | Per Capita |

|---|---|---|

| 11 | Illinois | $4,377 |

| 17 | Kansas | $3,954 |

| 19 | Arkansas | $3,873 |

| 24 | Iowa | $3,695 |

| 25 | Nebraska | $3,545 |

| 33 | Kentucky | $3,244 |

| 38 | Tennessee | $2,867 |

| 40 | Oklahoma | $2,831 |

| 45 | Missouri | $2,446 |

U.S. Average is $3,802

| National Rank | State | Per Capita |

|---|---|---|

| 13 | Kentucky | $8,450 |

| 21 | Illinois | $7,543 |

| 25 | Iowa | $7,021 |

| 28 | Arkansas | $6,736 |

| 36 | Kansas | $6,334 |

| 38 | Oklahoma | $6,095 |

| 42 | Nebraska | $5,642 |

| 43 | Missouri | $5,576 |

| 49 | Tennessee | $4,682 |

U.S. Average is $7,001

Income Tax Reductions that Disproportionately Benefit the Wealthiest Continue to Be Phased In

One of the costliest tax changes approved by lawmakers also reinforces the upside-down nature of Missouri’s tax structure. The reduction of the top rate of individual income tax from 6 percent to 4.5 percent will reduce state general revenue by $1.995 billion per year when fully implemented. This

change is also heavily weighted to benefit the wealthiest Missourians. The wealthiest one percent of Missourians (those with incomes above $591,000 per year) will get an average tax cut of nearly $18,000 – while a working family with an income of $43,000 per year will get just $216.

Next Steps of Implementation

When approved, lawmakers crafted some of the income tax rate changes to be implemented as of particular dates and others to be phased-in based on a “trigger” mechanism. As of January 2024, the top rate has been reduced from 6 percent to 4.8 percent. The final drop to a top rate of 4.5 percent is

based on a trigger formula that allows the top rate of income tax to drop by 0.1 percentage point per year if all of the following trigger requirements are met:

- The amount of net general revenue collected in the prior fiscal year exceeds the highest amount of net general revenue collected in any of the three fiscal years prior to it by at least $200 million.

- The amount of net general revenue collected in the prior fiscal year exceeds the amount of net general revenue collected in the fiscal year five years prior adjusted for inflation to the prior fiscal year.

Based on that formula, for the top rate of income tax were to drop by 0.10 percentage point in 2025, the amount of general revenue collected in Fiscal Year 2024 must be:

- $200 million higher than amount collected in Fiscal Year 2023 (which was the highest level compared to Fiscal Years 2021 – 2023), and

- Must exceed the amount of revenue collected in Fiscal Year 2019 adjusted for inflation to Fiscal Year 2024 ($9.57 billion adjusted by inflation over five years).

Demonstrating the Triggers for Tax Year 2025

| Dollar Amount Required | Trigger Reached | |

| First Trigger Provision | $13.43 billion | NO |

| Second Trigger Provision | $11.68 billion | YES |

Extraordinary federal COVID funding has boosted Missouri’s economy and temporarily increased state general revenue. That reprieve is coming to an end, and Missourians will begin to experience the consequences of reduced revenue for public services.