Tax Package Offers Little to Most Missourians and Poses Risk to Missouri in Future Years

For Immediate Release: September 29, 2022

Contact: Traci Gleason

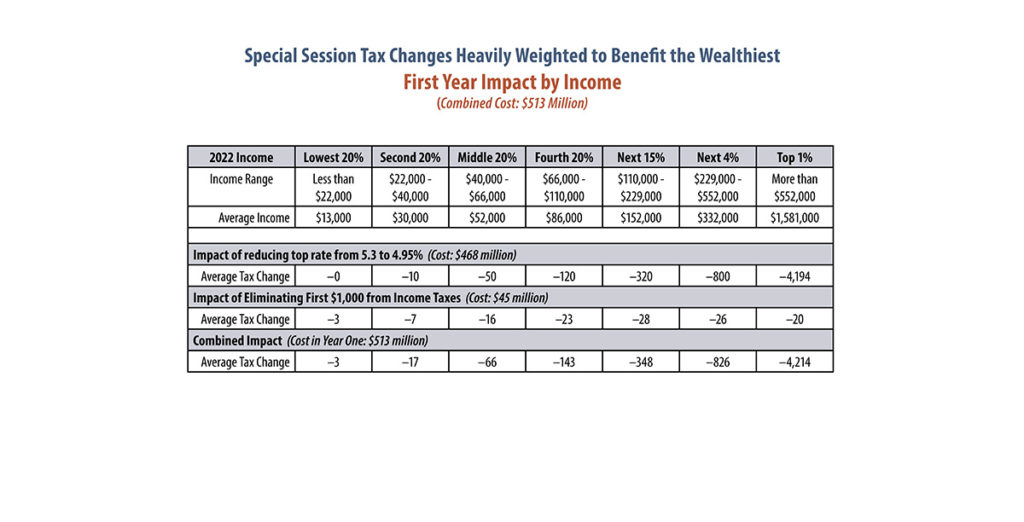

Today the Missouri House of Representatives chose to advance income tax changes that will have a big impact on state services but provide little help to most Missourians – all without providing an opportunity for amendments that could improve the legislation.

“The General Assembly has once again passed big tax changes that disproportionately help the wealthiest and leaves out one-third of Missourians altogether,” said Amy Blouin, President and CEO of Missouri Budget Project. “Millionaires will get thousands of dollars from the bill, but those middle-income folks who actually do see a cut won’t get much help in the face of today’s rising costs.”

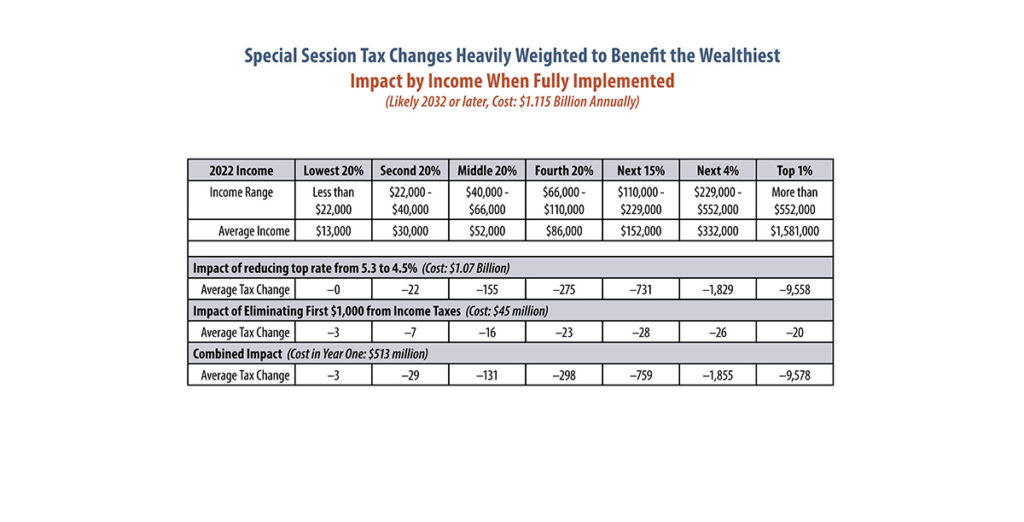

Even when the bill is fully implemented more than a decade from now, a middle-income family will see less than $11 per month. That may pay for an extra hamburger at that point, but it won’t do anything to help families struggling with increased costs for basics right now.

Although the tax policies have been sold as relief for working Missourians, the benefits are heavily skewed to the wealthiest, and leave out many working families and older adults living on fixed incomes. Policymakers could have included working families with low to moderate incomes by strengthening the state’s working families tax credit, and older adults by improving the circuit breaker tax credit, which hasn’t been increased since 2008.

These additions would have ensured that the measure reached all working families and helped to offset the steep increases in sales tax that families are facing due to inflation.

Moreover, the bill will decrease state revenue by over one billion dollars per year. Even with Missouri’s current robust budget, we have many unmet needs as a state – including struggling to take care of abused and neglected kids, as well as Missourians facing mental health crises.

Missouri is at the bottom of the barrel when its funding of many critical public services is compared to other states, or to Missouri’s own state funding in years past. For example:

- Between FY 2007 and FY 2020, there was a 22% cut in Missouri’s investment in programs to support independent living when adjusted to today’s dollars.

- While average incomes and property taxes increase over time, circuit breaker eligibility guidelines and the size of the credit have remained flat since the last increase in 2008. As a result, fewer people qualify for the credit over time and those that do are more likely to fall higher on the phase-out scale – meaning they qualify to receive a smaller credit. In addition, Missourians who rent from a facility that is tax-exempt were cut from the Circuit Breaker Program in 2018.

- When adjusted for inflation, required per student funding for K-12 schools was significantly lower in FY 2022 than it was in 2007. That is, the value of our state’s investment in its students is less than it was 15 years ago.

- Missouri’s investment in K-12 education is also far below the national average. Our state revenue spending per child is less than 60% of what the average state spends to educate its children.

- Even with today’s rosy budget, Missourians can’t access long term care through the Department of Mental Health, child welfare workers are overwhelmed, and the state’s foster care system is in desperate need. Vulnerable Missourians – including kids – are being put at risk because Missouri has the lowest paid state employees in the country, resulting in staff vacancies.

#

Missouri Budget Project is a nonprofit public policy analysis organization

that analyzes state budget, tax, and economic issues.