In February 2023, sales of recreational marijuana became legal in Missouri following voter approval of a state constitutional amendment that legalized marijuana for Missouri residents over age 21. This amendment included a six percent state sales tax on recreational marijuana. While this is a new source of revenue for the state, these dollars are not part of the state’s general revenue fund.

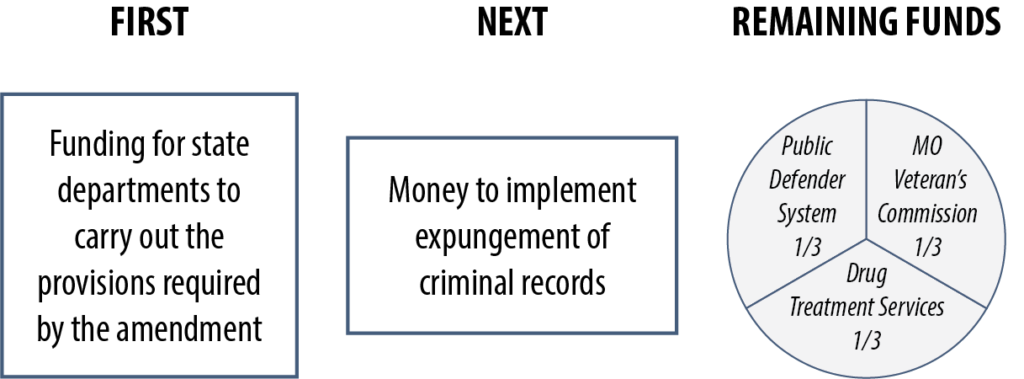

Instead, the amendment created the Veterans, Health, and Community Reinvestment Fund to house the revenue collected and distribute it in the following order:

Based on the pace of current sales, Missouri Budget Project estimates approximately $69.4 million will be collected through this tax annually.

Local Tax Revenue.

Localities in Missouri are allowed to place an additional three percent tax on recreational marijuana through a vote of the people. Unlike the state tax revenue, this revenue is not limited to specific purposes. Several counties and cities in Missouri have “stacked” these taxes, meaning that both the city and county levy separate three percent taxes on recreational marijuana, for a total of six percent in local taxes. Court cases that will determine the legality of “stacking” these taxes are in process.

Note Regarding Medical Marijuana:

The approval of recreational marijuana sales did not change rules regarding the sale or taxation of medical marijuana, which will continue to be taxed at a rate of four percent. A portion of revenue collected through the medical marijuana tax goes to the Department of Revenue and the Department of Health and Human Services to cover the cost of implementation, with the remainder earmarked for the Missouri Veterans Commission to provide services to veterans including operating and maintaining veterans’ homes, health, mental health, training and education, and housing assistance.