A number of tax changes made over the last three decades have resulted in an inadequate, upside-down tax system where low- and middle-income Missourians pay a higher share of their income in taxes than the richest Missourians, and out-of-state corporations pay less than their fair share for public services. This structure shifts the cost to hardworking Missouri families just trying to make ends meet and deprives our state of the revenue needed to support thriving communities, help families succeed, and promote Missourians’ way of life.

The following pages illustrate how Missouri’s tax structure compares to other states, including our neighbors, and how it shortchanges Missourians.

Missouri Invests Less In Its People Than Nearly All Other

States, Including Its Neighbors

Our state tax revenue helps pay for teacher salaries, supports adoptive and foster care families so that kids can grow in safe and loving environments, increases access to mental health services for those that need them, and provides for safe and thriving communities. Yet only five states in the nation collect less state revenue per capita than Missouri.

Federal funds also help pay state services. But even when both state and federal funds are included, only seven states spend less per capita on services for their residents.

Among all states, Missouri is ranked:

45th in the amount of state revenue it collects per person, and

43rd in the amount it spends per person (including federal funds)

This trend holds closer to home as well. Compared to its eight neighboring states, Missouri collects the least state revenue per capita, and ranks among the bottom in spending.

Missouri has consistently ranked near the bottom of these metrics for years.

2021 Per Capita State Tax Revenue

(Missouri & Neighboring States)

2021 Per Capita State Expenditures,

including State and Federal Funds (Missouri & Neighboring States)

| National Rank | State | Per Capita |

|---|---|---|

| 11 | Illinois | $4,377 |

| 17 | Kansas | $3,954 |

| 19 | Arkansas | $3,873 |

| 24 | Iowa | $3,695 |

| 25 | Nebraska | $3,545 |

| 33 | Kentucky | $3,244 |

| 38 | Tennessee | $2,867 |

| 40 | Oklahoma | $2,831 |

| 45 | Missouri | $2,446 |

U.S. Average is $3,802

| National Rank | State | Per Capita |

|---|---|---|

| 13 | Kentucky | $8,450 |

| 21 | Illinois | $7,543 |

| 25 | Iowa | $7,021 |

| 28 | Arkansas | $6,736 |

| 36 | Kansas | $6,334 |

| 38 | Oklahoma | $6,095 |

| 42 | Nebraska | $5,642 |

| 43 | Missouri | $5,576 |

| 49 | Tennessee | $4,682 |

U.S. Average is $7,001

How Missouri’s Tax Structure Compares

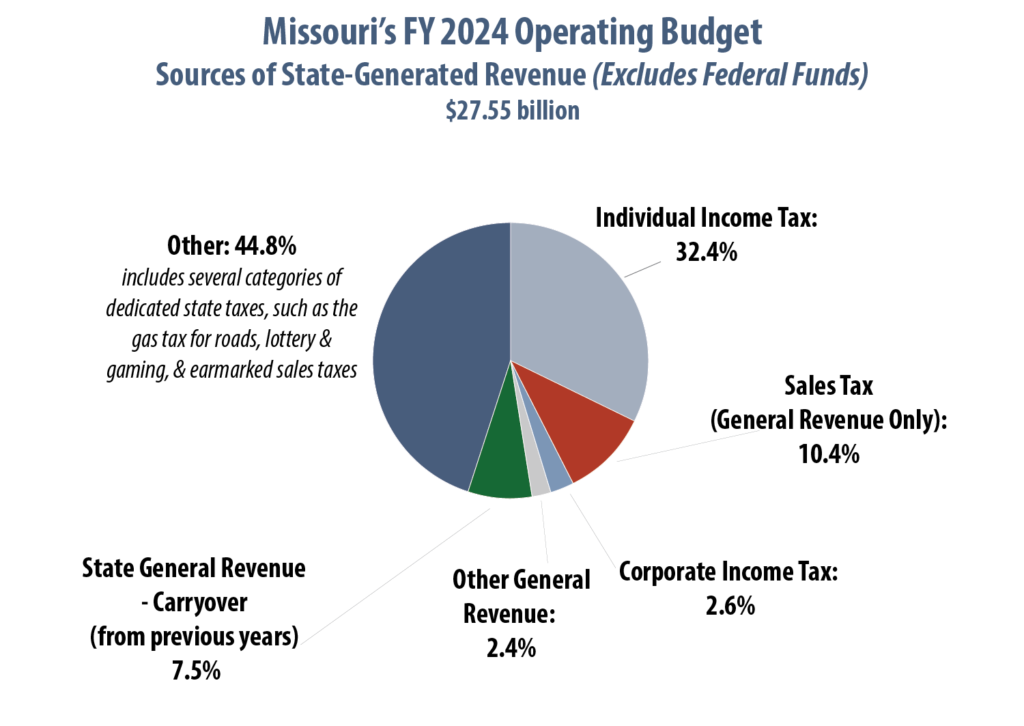

A variety of revenue sources contribute to the state public services Missourians rely on as a foundation to build their lives. In addition to federal funds, sources include income and sales taxes, gas and tobacco taxes, and lottery and gaming revenue. This diversity of funding sources provides more stability to the state’s budget, making Missouri less vulnerable to shortfalls that result from short-term economic changes.

However, several features of Missouri’s tax structure stand out compared to other states.

Missouri Earmarks More State-Generated Funds for Specific Purposes.

As a result, while state general revenue may appear heavily reliant on income tax, it makes up just 32% of all state-based revenue sources.

Missouri’s State Income Tax is Well Below Most States

- The top rate of income was cut from 6% in 2014 to 4.95% in 2023.

- As of 2023, Missouri’s top rate of income tax at 4.95% was lower than 26 other states and the District of Columbia – including our neighbor states of Nebraska, Iowa, and Kansas.

- The rate is also well below the national average of 6.3% for the 41 states plus the District of Columbia that levy an income tax.iii

- The top rate is scheduled to drop to 4.8% in 2024, which will make it lower than 32 other states. When already approved tax cuts are fully implemented, the rate will drop to 4.5%.

Missouri’s Tax Structure Favors Corporations

- Only one state in the nation has a top corporate income tax lower than Missouri’s rate of 4%.

- In addition, Missouri offers the most generous “Timely Filing Discount” in the country. It is one of 27 states that provide such “vendor discounts,” which allow retailers to retain a portion of the sales and use taxes they collect from customers if they remit those taxes to the state in a timely manner.

- Most states with these discounts either cap the amount or only apply the top discount to a limited amount of collections.

- Missouri’s timely filing vendor discount rate of 2% is one of the most generous in the nation.

- Missouri is also the only state in the nation to offer such a generous rate without any cap or limit on the size of that discount.

Missouri’s Share of State Sales Tax Revenue is Below the National Average –

But When Combined with Local Sales Taxes, Exceeds National Average

Of states collecting sales tax, only six states have a lower state sales tax rate than Missouri.

- When state tax reductions took effect, state revenue to fund services became more limited. Attempting to make up the difference, localities increased local sales tax rates and created multiple taxing jurisdictions resulting in “stacking” of sales tax.

- As a result, the average state and local sales tax in Missouri is now 8.36%, well above the national average of 6.59%.

Overall, the decreases in the top rate of income tax combined with higher local sales taxes have made Missouri’s tax structure more regressive.

- The regressive impact of increased sales taxes is compounded by the fact that sales tax is often applied to necessities such as food, diapers and period products.

- In fact, although the state applies a lower sales tax rate on food than on other products, Missouri is one of only twelve states that tax groceries

Lower Income Missourians Pay a Higher Share of Their

Income in State & Local Taxes Than Wealthiest

Tax changes made over the last decade have made Missouri’s tax structure more regressive, resulting in working families and Missourians with fixed incomes contributing a much larger share of their income to support public services than wealthy Missourians.

Extraordinary federal funding related to the pandemic has bolstered our state’s ability to invest in the services our communities need, improving the lives of Missourians. As these funds cease, and additional state tax decreases go into effect, the revenue our state has to invest in public services will further decline.