The past year saw a dramatic rise in housing values and property tax assessments in counties across Missouri, resulting in steep increases in property tax for many homeowners. At the same time, Missouri saw larger rent increases than any other state, with a 13.18% increase in just one year. These increases are pricing older adults and Missourians with disabilities, who have fixed incomes, out of their homes.

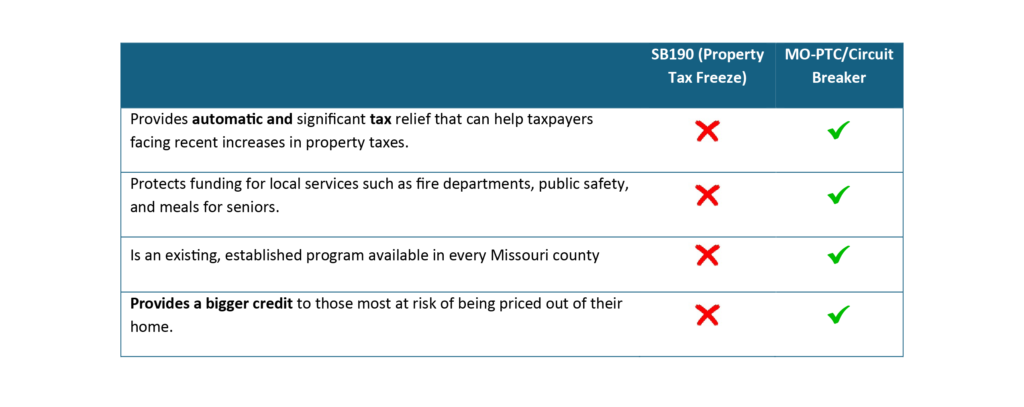

In response, state lawmakers passed SB190, a bill that allows counties to enact legislation to freeze property taxes for some older homeowners. A handful of Missouri counties have subsequently passed legislation to do so. However, local property tax freezes tied to SB190 do NOT address increased assessments that have already occurred. Rather, these freezes will apply only to future increases in assessments.

Luckily, the Missouri Property Tax Credit (also known as MO-PTC or “Circuit Breaker” tax credit) already helps older adults and Missourians with disabilities living on fixed incomes stay in their homes by providing a modest credit towards the cost of their property taxes.

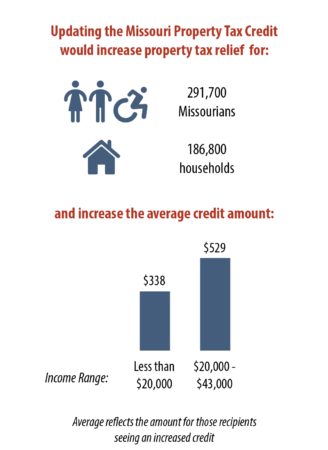

Legislators can provide meaningful and immediate tax relief by expanding eligibility for MO-PTC and by increasing the size of the credit to reflect rising costs of housing. (For more information on suggested improvements see MBP’s fact sheet Improving Missouri’s Property Tax Credit Would Help Seniors, Missourians with Disabilities Stay in Their Homes).