The Missouri Budget Project’s “Introduction to Missouri’s State Budget” outlines Missouri’s budget process, including where the state’s revenue comes from and how the state allocates funding.

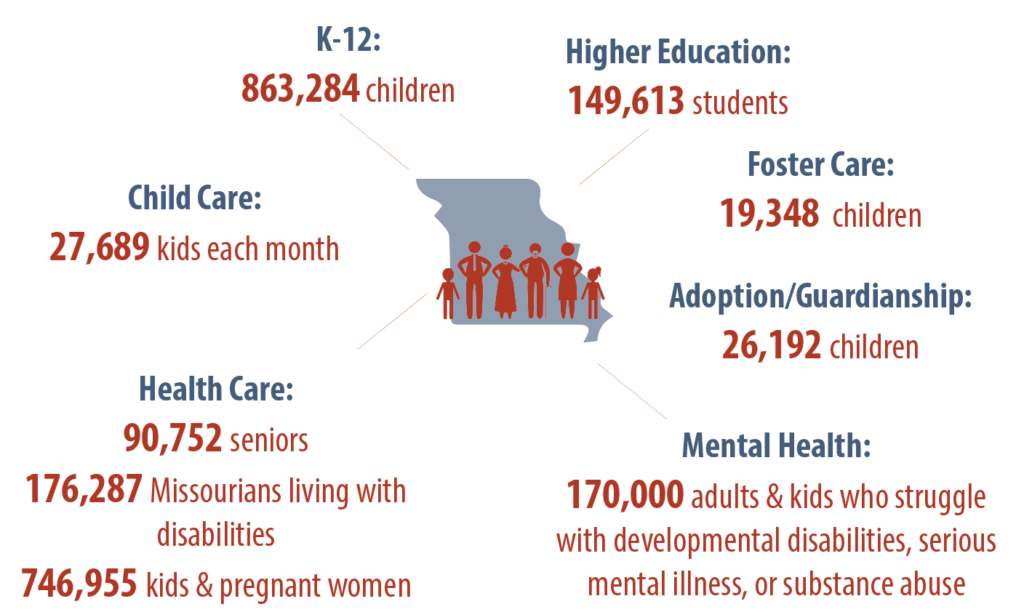

State Budget & Taxes: Impact at a Glance

The impacts of Missouri’s investments are far reaching, helping thousands of Missourians across the state reach their full potential.

Missouri Requires a Balanced Budget

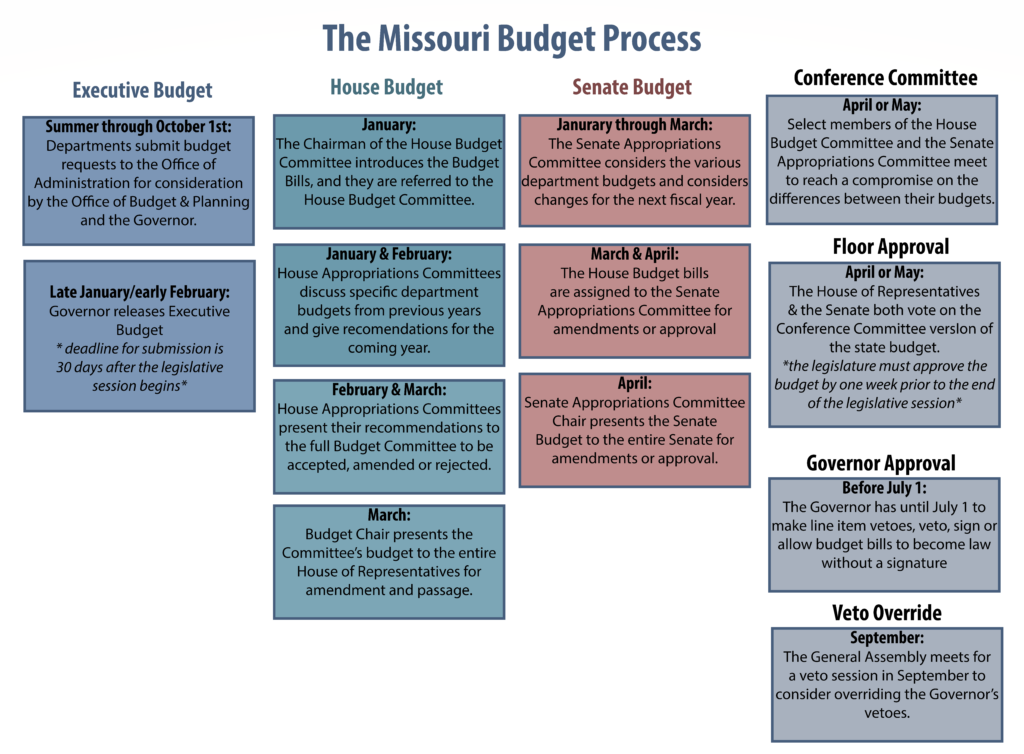

Developing the state’s annual budget is one of the most important – and complicated – responsibilities of Missouri lawmakers.

Missouri’s state constitution requires the budget to be balanced, so spending by the state cannot exceed incoming revenue.

The state’s fiscal year runs from July 1st to June 30th every year. Because the budget year begins in the middle of a calendar year, it is named for the coming calendar year. So, the budget that lawmakers will be debating in 2023 is the Fiscal Year 2024 budget.

The full legislature must pass its final budget one week prior to the end of the legislative session. In 2023, that means the legislature must pass the budget by May 5th.

Sources of Revenue to Support Missouri’s Budget

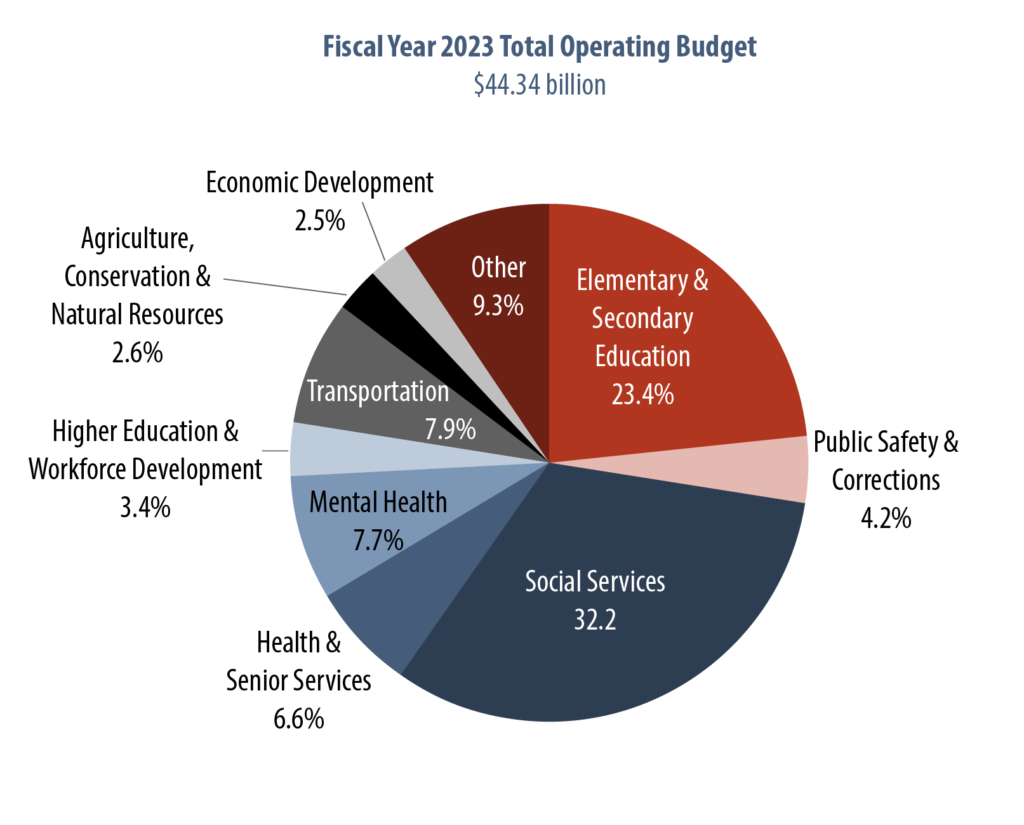

Missouri’s total operating budget for FY 2023 is $44.34 billion.

While this total DOES include federal funds distributed through the American Rescue Plan Act (ARPA) for health, education, child care, and other programs, it does NOT include flexible state fiscal recovery funds that were appropriated in House Bill 3020, a supplemental budget bill.

Note: Totals do not include spending in House Bill 3020, the COVID State Fiscal Recovery – ARPA Bill

The first source of funding in the budget comes from the federal government for very specific purposes.

Another source is state-generated revenue that is dedicated to specific purposes, and includes excise taxes like the gas tax, which is dedicated to transportation.

The final source of funding is referred to as state general revenue, which lawmakers have the most authority to allocate.

Federal Stimulus Funds

In 2020 and 2021, the federal government passed a series of COVID relief packages that included supplemental funding for states & localities, education, health care, and a range of other programs.

In order to spend the federal dollars allocated to Missouri, they must be accounted for as additional appropriations in the state budget.

The FY2023 budget includes $6.56 billion in appropriations from federal stimulus funds. This does not include flexible state fiscal recovery funds that were appropriated in House Bill 3020, a supplemental budget bill.

The operating budget for FY 2023 is larger than typical due to extraordinary fiscal relief in response to COVID. Some of the appropriations may be spent over more than one fiscal year, which is also unusual.

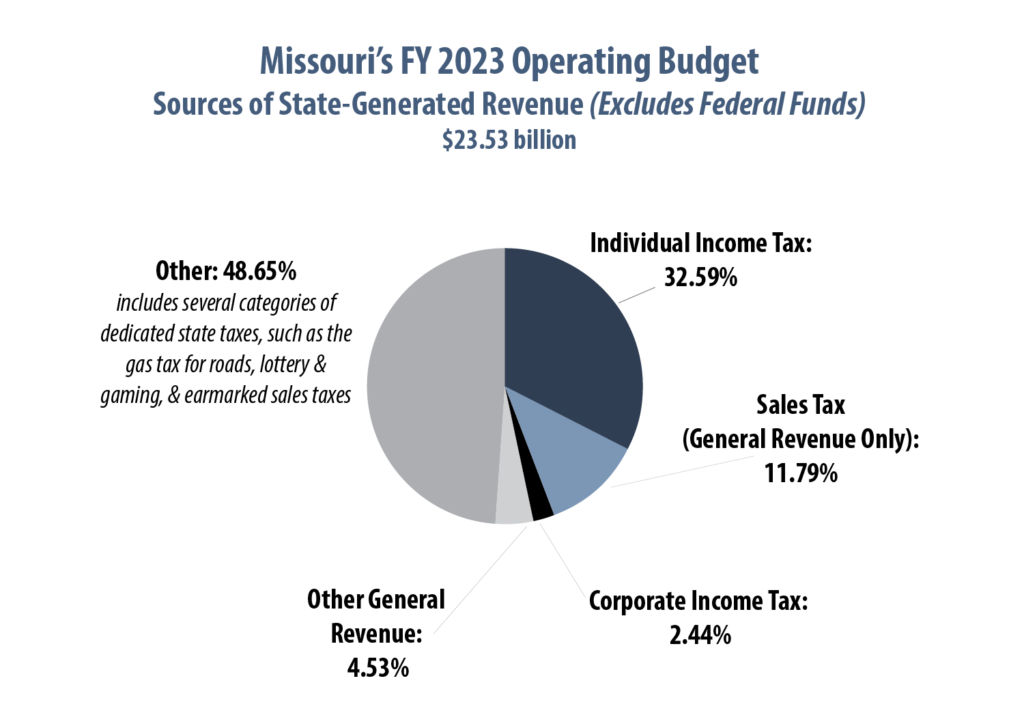

State-Generated Sources of Revenue

State budget needs are supported by a diverse base of state-generated tax revenue, including income and sales tax, gas and tobacco taxes, and lottery and gaming revenue.

The diversity of funding sources provides more stability in funding, making Missouri less vulnerable to shortfalls that result from short-term economic changes.

Compared to other states, Missouri earmarks more state-generated funds for specific purposes.

Missouri’s share of state revenue collected from corporate income is among the lowest in the nation and is nearly half the national average. Of the states that levy a corporate income tax, Missouri’s corporate income tax rate of 4% is lower than all but one state in the nation.

Missouri’s top individual income tax rate of 4.95% is lower than 28 other states, (including neighbor states of Nebraska, Iowa, & Kansas) – and well below the national average of 6.25%.

Of states collecting sales tax, only six have a lower state sales tax rate than Missouri. When local sales tax is included, Missouri’s average combined rate is 8.29%, well above the national average of 6.57%.

Lower Income Missourians Pay a Higher Share of Their Income in Taxes

Missouri’s overall tax system is regressive, which means the more income you earn, the less you pay in taxes as a percent of that income.

Missouri’s income tax structure is considered “progressive.” However, the tax tables have been only slightly adjusted since the 1930s. As a result, the highest income tax bracket in Missouri is only $8,449 in 2023.

The state’s tax structure has many additional regressive features, like the sales tax. Sales taxes are considered regressive because they require a higher contribution as a portion of income from those who earn less.

Many tax changes recently passed by the Missouri legislature disproportionately flow to the highest income brackets, including tax changes passed by the Missouri legislature in a special legislative session in late 2022.

As a result, the state tax structure becomes even more regressive because workers with low wages pay a larger share of their income to support the budget than wealthy Missourians.

Consensus Revenue Estimate

Because the state budget must be balanced every year, the legislature relies on an estimate of expected state revenue as a starting point for the budget process. Traditionally, lawmakers work together with the Governor to determine this estimate, which is referred to as the Consensus Revenue Estimate, or “CRE.”

The revised FY 2023 CRE is 1.4%, and the FY 2024 CRE is based on a forecasted increase of 0.7%.

As the budget process progresses, other revenues are considered. These other considerations may include a beginning balance, any lapses from the previous year, adjustments for legislative changes, and any other transfers to the general revenue fund.

The “Hancock Lid”

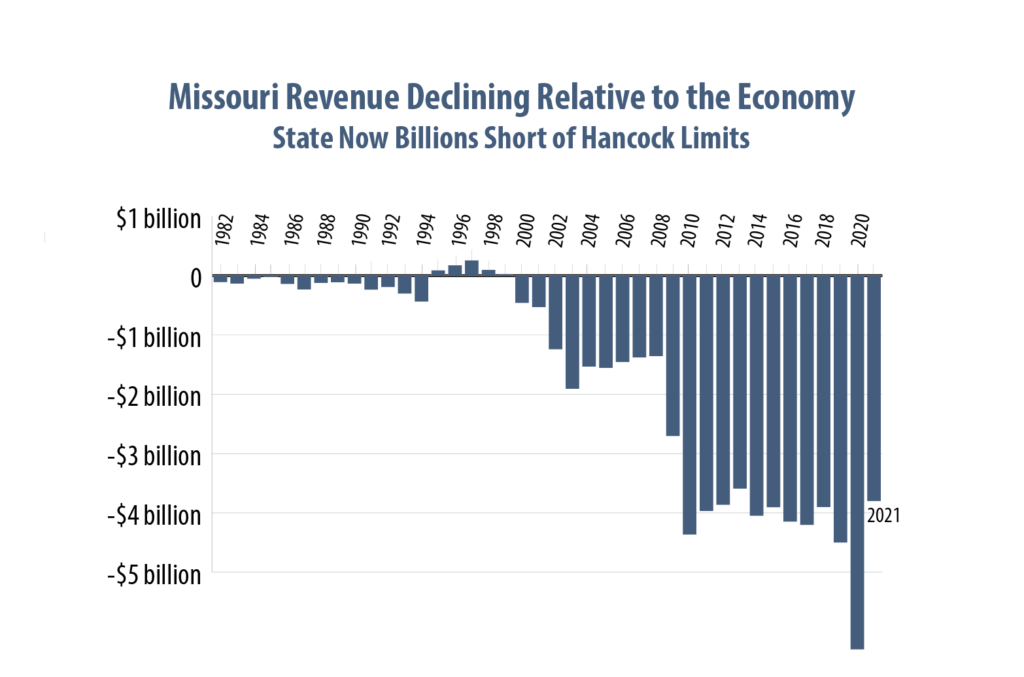

In 1980, the Constitution of Missouri was amended to limit the amount of revenue raised by the state. This is commonly referred to as the Hancock amendment.

The Hancock Amendment limits the amount of Missourians’ personal income that may be used to fund state government to no greater than the portion used to do so in 1981, when it was 5.6 percent.

Missouri revenue did not reach the Hancock limit until the late 1990s, when economic growth was exceptional. From 1995 to 2000, the state reached the lid every year and was required to refund nearly $1 billion to taxpayers.

Though a significant amount of money as a whole, the average Missouri family received a refund of just $40 over those five years.

Missouri revenue is now approximately $3.8 billion BELOW the Hancock lid.

Tax Cuts Follow After Hancock Lid Hit

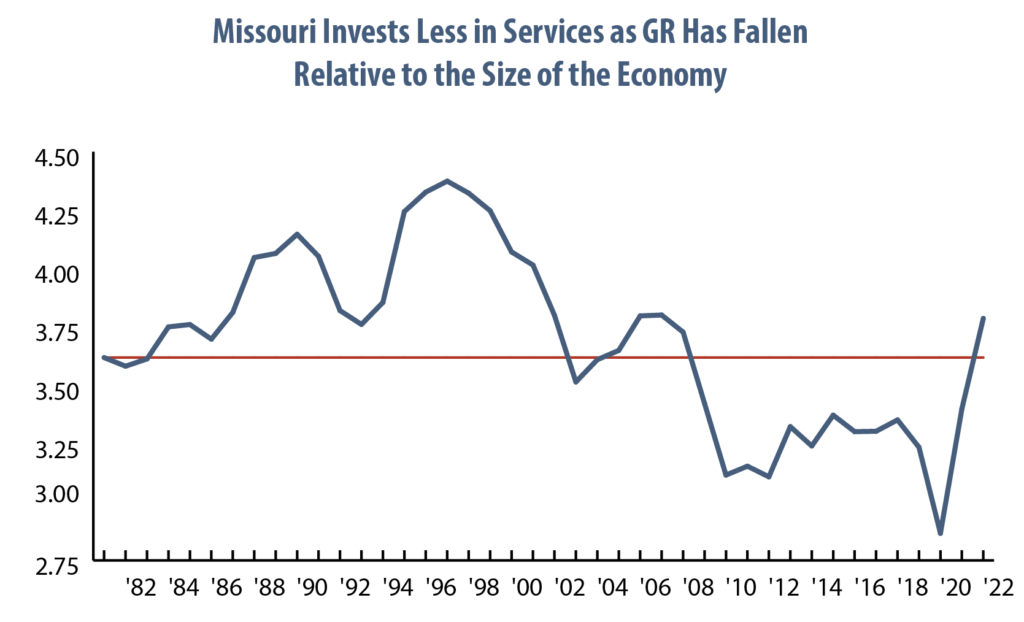

Since 2014, Missouri legislators made multiple tax changes that reduce state revenue.

While some of these cuts benefitted families, many were targeted to corporations, including a phase out of the corporate franchise tax and changes to the ways corporations can determine what profits are taxed.

Overall, the tax changes significantly diminished Missouri’s ability to invest in the services that help families, communities and the economy thrive.

During a special legislative session in 2022, Missouri’s General Assembly passed an individual income tax bill that disproportionately benefits Missouri’s wealthiest households. When fully implemented, the tax changes will reduce state revenue by more than $1 billion annually.

Combined, tax changes made since just 2014 will cost Missouri more than $1.8 BILLION every year.

Hancock Amendment & Voter Approval of Tax Increases

In fiscal year 2021, total state revenue was $3.8 billion under the Hancock refund threshold.

This is reflected in net general revenue collections, which have declined significantly as a portion of the economy (measured by Missouri personal income) since the Hancock amendment passed.

By nearly every measure, Missouri invests less in critical public services today than it did three decades ago.

Another part of the Constitution requires voters to approve taxes or fees passed by the General Assembly that exceed specific annual limits.

In fiscal year 2023, the legislature had authority to authorize tax changes that would generate up to $132.8 million.

Tax Credits Cost Missouri Over $579 Million Each Year

Many tax credits serve important policy goals. Some help low-income seniors remain in their homes or help nonprofits like food banks, domestic violence centers, or organizations serving pregnant women and children leverage donations. Others promote affordable housing or economic development.

The growth of tax credits has significantly reduced state general revenue, costing over $579 million in FY 2022, up from almost $515 million in fiscal year 2015.

Tax credits have policy benefits that cannot be overlooked, but the value and impact of the credits depend on how each of them are designed.

State Expenditures

The legislature outlines its recommendations for the state budget in 13 different House Bills, which are referred to as the budget bills. Each bill includes the spending recommendations for different state government departments and functions.

While most other bills are assigned a number in the order they are filed, the 13 operating budget bills are always the first 13 numbered bills and appropriate funds for the following functions:

- HB 1: Board of Fund Commissioners (public debt)

- HB 2: Elementary and Secondary Education

- HB 3: Higher Education & Workforce Development

- HB 4: Revenue and Transportation

- HB 5: Office of Administration & Employee Benefits

- HB 6: Agriculture, Natural Resources, Conservation

- HB 7: Economic Development, Commerce & Insurance, and Labor & Industrial Relations

- HB 8: Public Safety

- HB 9: Corrections

- HB 10: Mental Health, Health & Senior Services

- HB 11: Social Services

- HB 12: Offices of Statewide Elected Officials, Judiciary, & State Public Defender

- HB 13: Statewide Real Estate

The budget bills include the support from all funding streams, federal, state earmarked dollars and state general revenue dollars.

The most flexible of the funding streams is state general revenue because it does not include specific requirements for how it must be spent like the other funding streams do. Because of this, the state general revenue budget is generally what lawmakers spend the most time debating each year.