Submitted on Behalf of Amy Blouin, President & CEO of the Missouri Budget Project

Swapping out the income tax for a greatly expanded sales tax is a lose-lose proposal for Missourians, our communities and our economy:

– 60-80% of Missourians would see a net tax increase under this proposal.

– Based on consumer spending data from the US Bureau of Economic Analysis, and assuming that health care and housing would be exempt from the sales tax, the proposal would create a $5 billion hole in the state budget.

– Increasing costs for average Missourians by taxing the products and services they use every day will make it more difficult for Missouri families to get ahead. Cuts to public services including education, health and mental health and infrastructure will harm our communities. Both impacts will harm our economy and make it harder for Missouri to compete.

Increasing Taxes on Average Missourians

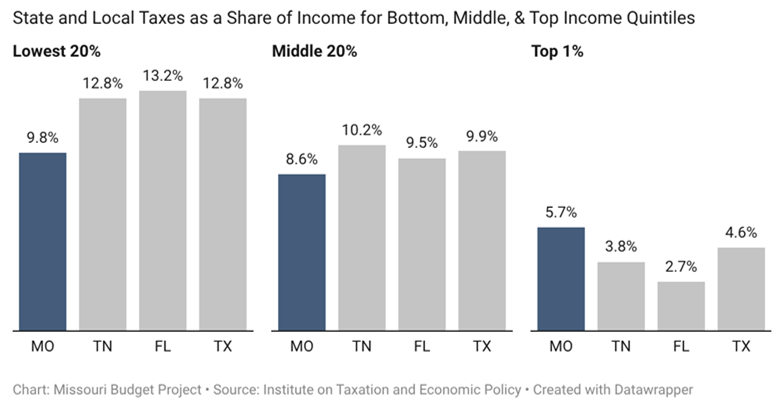

Missouri already has an upside-down tax structure, where Missourians earning the least contribute a higher share of their incomes than Missourians earning the most. If you make $20,000 a year, you pay almost 10% of your income in state and local taxes, but someone making $1.7 million pays less than 6% of their income in state and local taxes. Replacing the income tax with a greatly expanded sales tax will compound this.

In fact, the according to the Institute on Taxation and Economic Policy (ITEP), a median income Missourian, those making $65,400 per year, would face a $535 net tax increase under the scheme. The tax increase will be even more pronounced for seniors and those who rely on Social Security or public pensions for their income because their income is largely already exempt from income tax.

This tax increase results because Missourians don’t pay income tax on all of their income. In addition to exemptions on Social Security and pension income, is Missouri does not tax the income of active-duty military members nor income from serving in the National Guard or Reserves. In addition, most Missourians take the federal standard deduction, which reduces the income that is used to calculate state income taxes (the federal standard deduction for 2026 is $16,100 for single tax filers and $32,200 for married couples filing jointly).

Switching to a greatly expanded sales tax means that most Missourians will instead pay taxes on nearly every dollar of their income. Only the wealthiest 20% of Missourians – those with incomes nearing $300,000 and above – will see a decrease.

Creating a Massive Budget Hole

Missouri’s income tax supports nearly 2/3 of Missouri’s state general revenue budget – a critical state funding source for K-12 schools, mental health services, children’s services like childcare and foster care, and services for older adults like meals on wheels and respite care.

Assuming real estate and health care services are exempt, the proposed new sales taxes would generate significantly less revenue than the income tax – blowing a $5 billion hole in the state budget. That’s more than the general revenue the state contributes to local K-12 schools and higher education & workforce development combined – including the entire university system & community colleges, scholarships, and job centers & apprenticeships. The cuts to the state budget that would be required under this scenario would be catastrophic and would have reverberating impacts on Missouri’s communities and economy.

– For comparison, Individual Income Tax currently generates nearly $8 billion in revenue. The greatly expanded sales tax would only generate slightly more than $3 billion.

– Missouri already faces a $2 billion budget deficit resulting from previous tax cuts.

Estimated Revenue from Taxing Services in MO

Based on applying the 3% general revenue sales tax to consumer spending using Missouri Consumer Spending data from the U.S. Bureau of Economic Analysis

| Revenue Captured if ALL Services were taxed (including Health Care and Housing) | $6,511,692,000 |

| Less Health Care and Housing | (-3,451,881,000) |

| NET Tax Revenue Captured by Taxing Services (Less Health & Housing/Utilities) | $3,059,811,000 |

Impact on Economy

Proponents of eliminating the income tax often point to states that don’t have an income tax as a “model”. However, these states have resources that Missouri does not have – like gas, oil and other natural resources – AND their sales and property taxes result in higher taxes on average families than Missouri.

States such as Tennessee, Florida, and Texas that do not levy an income tax are not low-tax for everyone. Instead they are only low-tax for the wealthy, while low-and-moderate income earners pay a higher share of their income in state and local taxes as compared to Missouri and most other states.

If Missouri were to follow in these footsteps, average families would pay more and have less discretionary income to use in the local economy.

States With No Income Tax Are Only Low Tax For the Highest Income Residents

Comparisons to states that do not levy an income tax are often comparing apples to oranges. Each state economy is driven by unique conditions that don’t always translate to Missouri.

While Texas has seen rapid growth in Gross Domestic Product (GDP) in recent years, the primary driver of that growth is the oil and gas industry. In fact, Texas is by far the leading producer of both oil and gas in the nation, an option not available to Missouri.

Florida and Tennessee both rely heavily on tourism. This tourism drives growth – but also allows the states to tap into additional revenue streams, such as taxes that are levied primarily on out-of-state visitors. For comparison purposes:

– Branson (including Silver Dollar City) receives 10 million visitors/year,

– Orlando (including Disney and Universal Resorts) receives 68 million visitors.

– Great Smoky Mountains National Park receives 12 million visitors/year, while the Gateway Arch National Park sees just 2.5 million visitors/year.

Sustainable economic growth is driven by real improvements in the lives of everyday Missourians, not tax cuts for millionaires. Over the past decade, Missouri has passed tax cuts that cost the state $3.8 billion each year. If tax cuts were the key to economic prosperity, Missouri would already be seeing the benefits. But real economic prosperity is complicated, and driven by a range of factors.

This means that there is no clear economic picture when comparing Missouri to states with income tax. In some areas, Missouri significantly outperforms states that do not levy an income tax – particularly those measures that more directly assess economic conditions for average residents. In other areas, Missouri’s economic indicators are similar to or underperform these other states – a reflection of the fact that these states each have unique economies and demographic compositions.

| Personal Income Growth (Q1-Q2 2025) | GDP Growth (Q1-Q2 2025) | Labor Force Participation | Unemployment Rate | Long-Term Unemployment Rate | |

| MO | 6.4% | 3.10% | 63.2% | 3.5% | 0.44% |

| FL | 6.7% | 3.30% | 57.9% | 3.1% | 0.61% |

| TX | 6.4% | 6.80% | 65.2% | 4.1% | 0.78% |

| TN | 3.9% | 3.10% | 59.5% | 3.3% | 0.87% |

| US | 5.5% | 3.80% | 62.6% | 4.0% | 0.86% |