A Missouri EITC would boost local communities and economies while encouraging work, enhancing take-home pay, and improving long-term health and economic outcomes for more than 500,000 Missouri families.

Earned Income Tax Credits:

Targeted Tax Credits with Significant Impact

(EITC) in Missouri would give a much-needed break to Missourians struggling to get by on low wages. A state EITC would boost local communities and economies while encouraging work, enhancing take-home pay, and improving long-term health and economic outcomes for more than 500,000 Missouri families.

EITC Basics

The federal Earned Income Tax Credit (EITC) is a federal tax credit for low- and moderate-income working people. It encourages and rewards work as well as offsets federal payroll and income taxes.

For families with very low earnings, the value of the EITC increases as earnings increase. Working families with children earning up to about $41,000 to $56,000 (depending on marital status and the number of dependent children) may be eligible for the federal EITC.

Also, working individuals that have incomes below about $15,570 ($21,370 for a married couple) can receive a very small EITC. In tax year 2017, the most recent year for which the data are available, more than 494,000 Missouri families received the federal EITC.

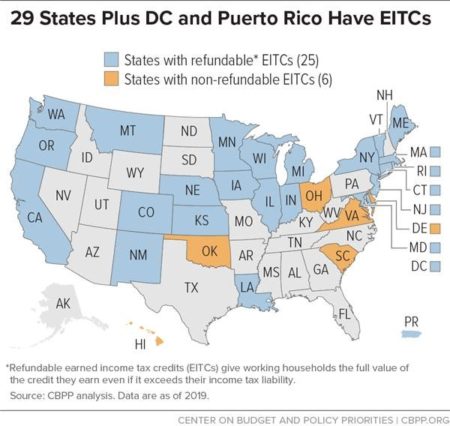

In that year, the average federal EITC was $3,191 for a family with children, boosting wages by about $266 a month. Because of the success of the federal EITC, twenty-nine states and the District of Columbia have established their own state EITCs, including several of Missouri’s neighbors: Oklahoma, Kansas, Iowa, Illinois, and Nebraska.

Benefits of the EITC

The EITC benefits both individual families, and the larger society as a whole.

The EITC is good for local businesses and the economy: Low-wage workers spend savings from the EITC at local businesses to meet daily needs, like buying groceries or paying for car repairs or child care.

EITCs help families pay for necessities: By enhancing take home pay, families can better afford to repair homes, maintain vehicles that are needed to commute to work, and in some cases, obtain additional education or training to boost their employability and earning power.

EITCs encourage work: A significant body of research indicates that the EITC was more significant in encouraging the rise in employment among low- income single mothers with children during the 1990s than either welfare reform or the economy.

EITCs improve the educational outcomes of young children in low-income families: A growing body of recent research indicates a strong correlation between increases in family income from tax credits and statistically significant increases in school performance, including test scores.

EITCs have lasting economic benefits: Additional research indicates that refundable tax credits like the EITC increase the lifetime earnings of children in low-income families. Research demonstrates that for every dollar of income provided in tax credits, the value of a child’s future earnings is increased by more than one dollar.

Proposals to Establish a State EITC

House Bill 1605 would create a non-refundable Missouri EITC equal to 20 percent of the value of the federal credit.7 Many of the 515,828 families that are eligible for the federal EITC could be eligible for the new Missouri EITC if HB 1605 were approved.

Based on data from the Institute on Taxation and Economic Policy, Missouri families with incomes ranging from $20,000 – $37,000 would receive the greatest impact from the bill.

Missourians in the bottom three income quintiles would receive average tax reductions ranging from $54 – $289 per year depending on family size and income.