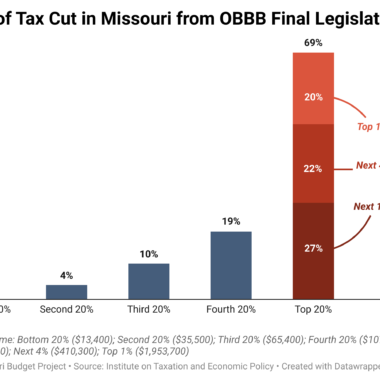

Schools Face 18% Cut Under Tax Scheme

Off

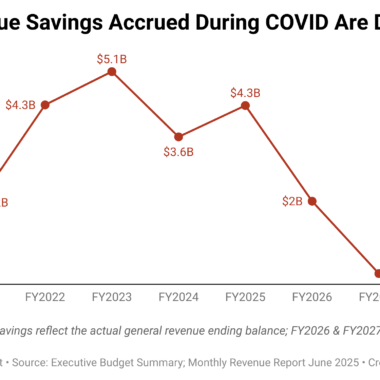

Lawmakers are considering swapping out the income tax for a greatly expanded sales tax. The proposal would blow a $5 billion hole in the state budget, causing massive cuts to schools, particularly in rural areas.1 If resulting budget cuts are equally distributed across the Read More