A proposal touted as an elimination of Missouri’s income tax is in reality the introduction of a two-step process that could swap the individual income tax for greatly expanded sales taxes. This switch would increase total taxes for up to 4 out of 5 Missourians and harm our state’s economy.

If approved by lawmakers, the proposals – House Joint Resolutions 173 and 174 – would:

– Present a state constitutional amendment to Missouri voters that, if approved at the ballot, would give lawmakers unchecked authority to expand sales taxes.

– Allow a future legislature to approve broad sales tax increases on the promise of phasing out the personal income tax.

If both part of this scheme were to become a reality, it would:

Increase taxes for most Missourians:

– 60-80% of Missourians would see a net tax increase under this scheme.

– Only the wealthiest 20% of Missourians – those with incomes nearing $300,000 and above – would see a decrease in their taxes.

– A middle-income Missourian earning $65,000/year would face a $535 net tax increase.

– Older adults and active duty military, whose income is largely exempt from income tax, will have a much steeper tax increase.

Cut the services Missourians, our communities, and the economy rely on, like education:

– The proposal would create a nearly $5 billion hole in the state budget.

– In context, that’s more than the amount of general revenue Missouri contributes to local schools, higher education and workforce development combined.

Harm our state’s economy:

– By taxing the products and services Missourians use every day, costs would increase, making it more difficult for Missouri families to get ahead and slowing economic activity.

– Public services like education, health and mental health, and infrastructure are key drivers of economic growth. Cuts to these services will harm Missourians and make it harder for our state to compete.

Summary of House Joint Resolutions 173 & 174

These plans (House Joint Resolutions 173 & 174) are being discussed in the context of a longer-term scheme to swap the income tax for a greatly expanded sales tax, but the proposed amendments themselves do not enact any of these changes. If approved by the legislature this year, and approved by voters:

State legislators could impose new sales and use taxes on any goods or services, as long as they indicate those taxes are intended to reduce or phase out the state individual income tax.

WHAT THIS MEANS:

– Future lawmakers would have the ability to tax goods and services they are currently prohibited from taxing.

– Those legislators would no longer be limited by existing restrictions regarding how much they can raise sales taxes.

Require any political subdivision to offset any sales tax increases resulting from subsequent state legislation with an equivalent cut to property taxes, earnings taxes, or sales tax rates.

WHAT THIS MEANS:

– Because localities are already very limited in their ability to generate revenue, these restrictions would put funding at risk for critical local services including K-12 education, public safety, services for older adults and people with disabilities, libraries, and parks.

ANALYSIS OF PROVISIONS

Sales Tax Base

The Missouri Constitution currently prohibits state and local sales and use taxes on services that were not taxable as of January 2015. These measures would ask voters to remove this prohibition, allowing state lawmakers to expand the sales tax.

The language does not set parameters related to what/how these taxes would be implemented, and removes existing voter oversight over tax increases.

– For instance, it allows sales taxes to be expanded based on the stated intention that income taxes would be phased out, regardless of whether those changes are implemented.

– Existing state constitutional provisions require voter approval of tax increases above a certain amount, but the proposed amendment exempts sales tax expansions from this requirement for three years – allowing legislators to act without voter oversight.

The measure does not define which services would be subject to the sales tax – meaning all services – including rent, health care, and mortgages – could be subject to the tax.

– Although Governor Kehoe indicated in his State of the State address that health care and real estate would be exempted, no exemptions are included in the proposals.

– If future lawmakers chose to do so, they could tax everything including rent, education and child care services, health and mental health services and products, haircuts, manicures and pedicures, veterinarian services, pet grooming and boarding, accounting, legal assistance, home and car maintenance services, even funeral services, and much more.

– When considering the proposals, voters would have to simply trust that future lawmakers would not apply the sales taxes to certain services.

Restrictions on Localities

The measures also significantly restrict municipalities, counties, and political subdivisions in their ability to raise revenue for local services. Changes made to the base of taxable services and products would automatically apply to local sales taxes; but the amendments require that any increase in local revenue resulting from an expanded sales tax base be offset with equivalent cuts to local revenue.

The proposal requires local governments to annually reduce revenue by an amount equal to any increase in collections tied to an expanded sales tax base.

– Cuts to sales tax rates, property taxes, or earnings taxes could all be used to offset increased sales tax collections.

It is not clear which jurisdictions these provisions apply to. Specifically, it is uncertain whether levies created to provide funding for fire, ambulance, and emergency medical services, health and mental health services, or services for older adults, children, and people with developmental disabilities are exempt.

WHAT IT MEANS FOR MISSOURIANS:

THE CONSEQUENCES OF INCREASED SALES TAXES

These Proposals Raise Total Taxes for Most Missourians

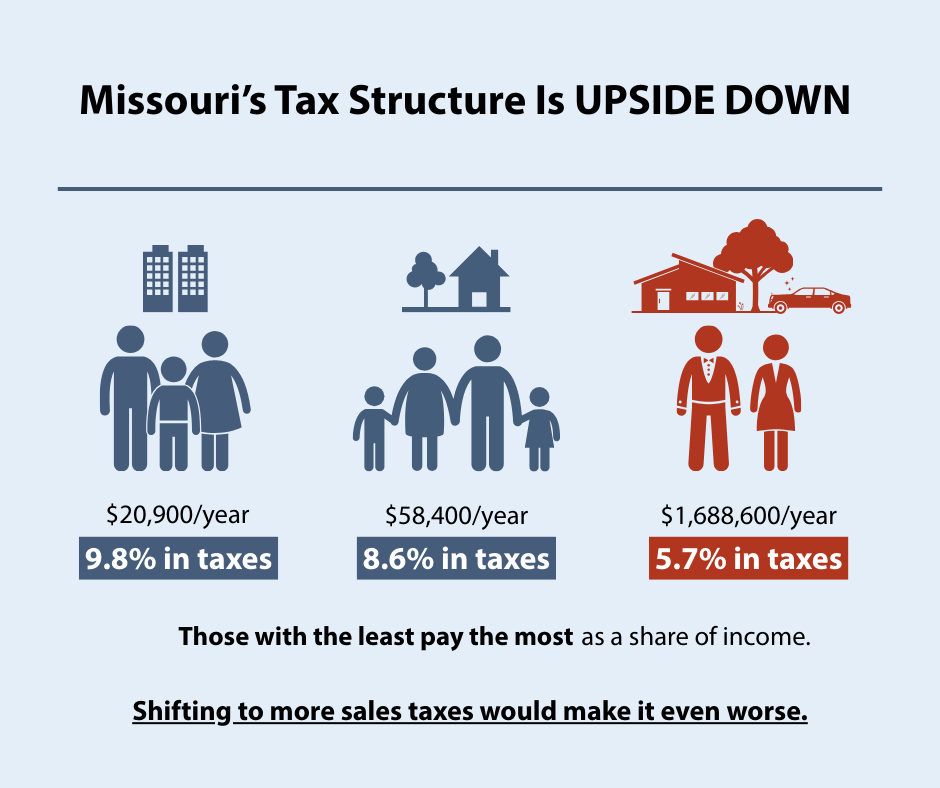

Missouri already has an upside-down tax structure, where Missourians earning the least contribute a higher share of their incomes than Missourians earning the most. If you make $20,000 a year, you pay almost 10% of your income in state and local taxes, but someone making $1.7 million pays less than 6% of their income in state and local taxes.

Replacing Missouri’s income tax with a greatly expanded sales tax will make Missouri’s upside-down tax structure even worse.

A median income Missourian – those making $65,400 per year – would face a $535 net tax increase under the proposed tax scheme.

Moreover, Missouri’s older adults and members of the military will face a double whammy and be particularly harmed.

– Older adults and other Missourians who rely on Social Security or public pensions for their income are already mostly exempt from income tax.

Missouri also does not tax the income of active-duty military members nor income from serving in the National Guard or Reserves.

– As a result, they will not see any gain from reduced or eliminated income taxes, but will face severely increased sales tax costs.

State Would Face a Massive Budget Hole, Requiring Cuts to Education & Other Services That Build Opportunity for Missourians

Missouri’s income tax supports nearly 60% of Missouri’s state general revenue budget. It’s a critical state funding source for K-12 schools, mental health services, children’s services like childcare and foster care, and services for older adults like meals on wheels and respite care.

The proposed new sales taxes would blow a $5 billion hole in the state budget, causing massive cuts to the building blocks of our economy.

– Assuming real estate and health care services are exempt from the expanded sales tax as the Governor said, the new sales taxes would generate about $5 billion less revenue than the income tax.

– That’s more than the general revenue the state contributes to local K-12 schools and higher education & workforce development combined – including the entire university system & community colleges, scholarships, and job centers & apprenticeships.

– Even if real estate and health services were also taxed, Missouri would be forced to cut billions.

– The cuts to the state budget that would be required under this scenario would be catastrophic and would have reverberating impacts on Missouri’s communities and economy.

New Sales Taxes Would Blow Nearly $5 Billion Hole in Budget, Require Huge Cuts to Missouri Public Services

| Individual income tax collections (not including pass-through entities) | $7,817,300,000 |

| Revenue collected if ALL Services were taxed, less health care & housing | $3,059,811,000 |

| Difference Between Income Tax & Expanded Sales Tax | $4.8 billion |

Missouri’s ability to deliver services is already strained.

– Missouri already faces a $2 billion budget deficit resulting from previous tax cuts.

– Moreover, when federal cuts to health and nutrition assistance are fully implemented, Missouri will face an additional $1 billion a year in costs just to maintain services.

Local Communities at Risk

As Missouri has disinvested in public services, communities have frequently picked up the slack to provide resources their residents need and value, relying on locally approved sales or property taxes.

– These services include things like mental health and substance abuse prevention and treatment for kids; and resources to help older adults stay safely in their communities, like assistance with minor home repairs, social support, and food assistance.

HJR 173 & 174 restrict local decision-making and would hamper the ability of cities and counties to respond to local needs and could lead to significant cuts to existing services funded at the local level – disregarding voter intent in those communities.

– Localities are already restricted on the types of revenue they can raise to support local services and deliver what their residents need to thrive.

Damages Missouri Economy

Tax cuts don’t work.

Sustainable economic growth is driven by real improvements in the lives of everyday Missourians.

Investments such as access to affordable healthcare, child care, and quality K-12 and higher education are key drivers of economic growth and critical to attracting and retaining a skilled workforce and quality employers.

Research shows that each dollar invested in services grows the economy by more than the initial investment – while tax cuts generate less than the initial investment:

– Every dollar invested in programs that support everyday Missourians generates economic growth – and provides much more “bang for the buck” than broad based income and corporate tax cuts.

– Investments in education are one of the primary predictors of economic growth.

Yet Missouri provides less state support for child care than almost every other state in the nation, a lack of investment that recently resulted in a wait list as Missouri can no longer provide support to all eligible parents. Each year Missouri loses out on over $1 billion of economic growth due to child care shortages. Investing in child care so that parents can go to work would go much further to grow our economy than ill-advised tax cuts.

Further, shifting to a dramatically expanded sales tax base would dramatically increase daily costs for Missourians and dampen consumer spending in communities across the state. This would have ripple effects on Missouri’s economy.

Finally, Missouri’s recent history proves tax cuts don’t work. Over the past decade, state lawmakers have passed tax cuts that cost the state $3.8 billion each year. If tax cuts were the key to economic prosperity, Missouri would already be seeing the benefits.

Instead, years of tax cuts aimed at the wealthy and corporations have eroded Missouri’s ability to invest in the services and infrastructure that ensure every Missourian can thrive and which allow all families to get ahead.