During the 2025 State Legislative Session, lawmakers passed House Bill 594, which exempts capital gains from income tax, making Missouri the only state in the nation that levies an individual income tax that does not also tax capital gains.[i] Capital gains are income generated from the profits individuals and businesses make on stocks, cryptocurrencies, real estate and other valuables.

The exemption is expensive and will reduce state general revenue by at least $341 million and likely in excess of $600 million. This amount could fluctuate and increase significantly as corporations and wealthy Missourians take advantage of the exemption. In context, $600 million would be the equivalent of 25 percent of state general revenue funding for local schools.

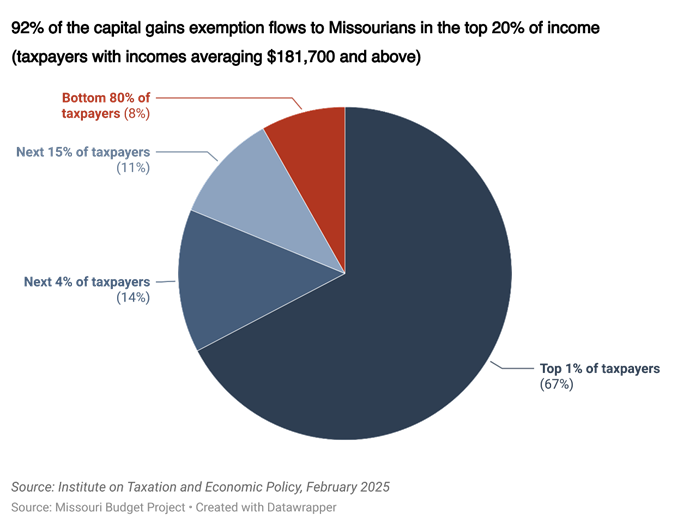

This exemption largely benefits the wealthiest individuals and corporations.

The exemption would apply to both individual and corporate income tax. The individual income tax provisions would take effect immediately, while the corporate tax provisions would not take effect until the year after previously approved tax cuts lowering the top individual tax rate to 4.5% are fully implemented.[ii]

As shown in the following table, the exemption will make Missouri’s upside-down tax structure even more regressive. The wealthiest 1 percent of Missourians will see their state and local taxes cut by 14%, while the lowest income Missourians will continue to pay a significantly larger portion of their income in state and local taxes.

Missouri’s State and Local Tax Structure Will Become More Regressive With Capital Gains Exemption

Impact of Capital Gains Cut by Income Group

| 2025 Income | Bottom 20% | Second 20% | Third 20% | Fourth 20% | Next 15% | Next 4% | Top 1% |

|---|---|---|---|---|---|---|---|

| Average Income | $14,500 | $37,200 | $66,200 | $109,900 | $181,700 | $397,900 | $1,898,400 |

Current Percent of Income Paid in State and Local Taxes by Income Group

| 9.8% | 8.5% | 8.6% | 8.9% | 8.7% | 7.3% | 5.7% |

After Exempting Capital Gains from Income Tax

| 9.8% | 8.49% | 8.57% | 8.84% | 8.61% | 7.1% | 4.91% |

Exempting Capital Gains from Income Tax is Costly.

The official fiscal note for House Bill 594 indicates that the capital gains cut would cost $341 million in the first year. However, independent analyses conducted by the Institute on Taxation and Economic Policy (ITEP) found that the cost of the individual income portion of the capital gains exemption alone could $600 million or more each year. The ITEP analysis is based on publicly available data from the Internal Revenue Service, which shows that Missourians reported $13 billion in capital gains income in 2022 alone.[iii] It is unclear why Missouri’s fiscal note determined a much smaller number, but what is clear is that the final cost of this bill could be hundreds of millions above official estimates.

[i] Tax Foundation. (2024) State Tax Rates on Long-Term Capital Gains, 2024 Available: https://taxfoundation.org/data/all/state/state-capital-gains-tax-rates-2024/ Accessed 6/12/2025

[ii] Missouri’s top income tax rate is being gradually being lowered from 6% to 4.5%. MO’s current top tax rate is 4.7%, meaning two more triggers must be met for the top rate to be lowered to 4.5%, thus activating the corporate capital gains exemption.

[iii] Internal Revenue Service, Statistics of Income (SOI), SOI Tax Stats – Historic Table 2, 2022, Available: https://www.irs.gov/statistics/soi-tax-stats-historic-table-2 Accessed 6/23/2025