Recent dramatic increases in housing values and property tax assessments in counties across Missouri have resulted in steep property tax increases for many homeowners, threatening housing stability for older adults, many of whom live on fixed incomes and are at risk of being priced out of their homes and away from their neighbors and communities.

In an attempt to address these challenges, state lawmakers passed legislation that allows counties to implement a freeze on property taxes at the current level for homeowners 62 and older.2 Unfortunately, the freeze will be of little help to seniors struggling with recent property tax increases because it only applies to future increases – that is, it does not provide any immediate tax reduction or alter property taxes that have already gone up. Furthermore, despite lawmaker efforts to clarify the legislation, several legal questions remain that could have significant implications for the program’s impact and rollout.

Overview of Property Tax Freeze for Homeowners Aged 62+

In counties that implement the freeze, property tax bills will be frozen based on the year that an eligible older adult was approved for the program. However, there are some important exceptions to the freeze, which mean that property taxes will continue to increase under certain circumstances.

| Impacts of Property Tax Freeze on Tax Amounts |

|---|

| Approved older adults will not receive any tax refunds or money back. Rather, the program will stop (or in some cases slow) future growth in the size of property tax bills. Because the property tax freeze is not retroactive, it does not provide relief in response to property tax increases that have already occurred. Since property taxes are reassessed biannually, the increases due to the 2025 reassessment will be the first opportunity for the freeze to be implemented in most counties. Property tax increases resulting from new construction or major improvements are not subject to the freeze and would result in an increased property tax amount. Some counties have excluded property tax revenue streams designated for specific purposes (such as senior services or schools) from the freeze. In these counties, older adults would see property tax amounts for taxing jurisdictions other than the county continue to rise. |

Legal Questions Remain

Despite attempts from legislators to clarify the law, legal questions remain about its implementation. These questions may end up contested in the courts and could significantly affect the reach and effectiveness of the freeze.

- Although homeowners only make one property tax payment, the payment is divided among various entities, known as taxing jurisdictions. The Missouri Constitution treats counties other taxing jurisdictions, such as schools, senior funds, and firefighting districts as separate entities. This means counties likely do not have the legal authority to limit taxes for those separate jurisdictions. Amounts vary by county, but the portion of a property tax bill designated for other taxing jurisdictions can make up most of the bill.

- In addition, some counties have capped eligibility for the freeze based on property value, and it remains unclear whether this is allowable under state law.

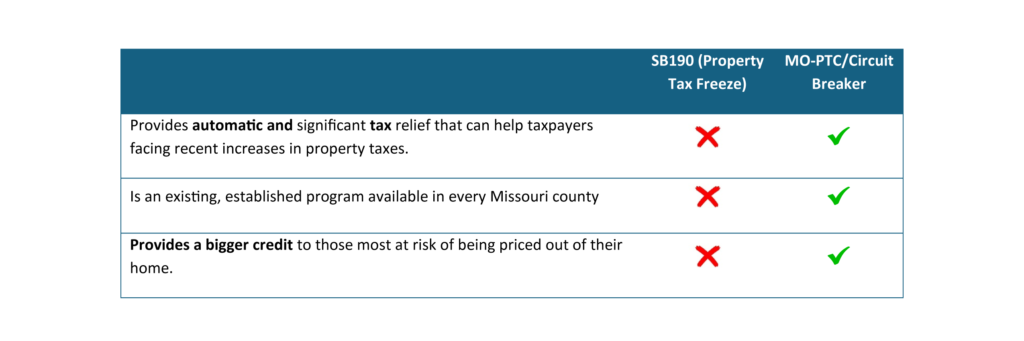

Strengthening the Existing Missouri Property Tax Credit (MO-PTC or “Circuit Breaker”) Would Provide Meaningful and Immediate Tax Relief to Those Who Need It Most.

Given the continued uncertainties and challenges under the state legislation, lawmakers should consider alternative ways to assist older adults grappling with rising housing costs, especially to reach more Missourians living on fixed incomes and at risk of being priced out of their homes. Missouri has an existing program that helps older adults and Missourians with disabilities living on fixed incomes stay in their homes. The Missouri Property Tax Credit (also known as MO-PTC or “Circuit Breaker” tax credit) provides a modest credit towards the cost of property taxes or rental costs for seniors and people with disabilities.

Unfortunately, however, the program has not been updated in years, rendering it less effective. Expanding and increasing the Missouri Property Tax Credit to reflect the rising costs of housing would provide meaningful and immediate tax relief to those who need it most. (For more information on suggested improvements to the Circuit Breaker, see MBP’s fact sheet Improving Missouri’s Property Tax Credit Would Help Seniors, Missourians with Disabilities Stay in Their Homes).