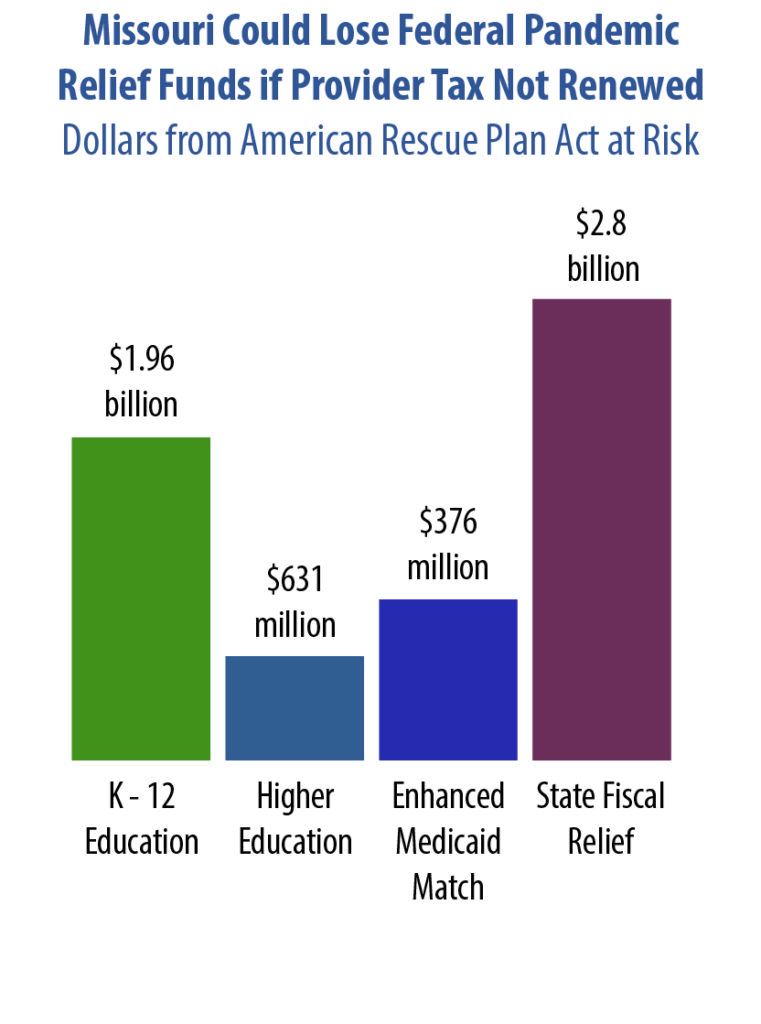

Failure to renew the state’s Medicaid provider taxes would not only cost Missouri the funding associated with those taxes and their corresponding federal Medicaid match, but could also put up to $5.7 billion in additional federal dollars from the American Rescue Plan at risk.

Drastic state budget cuts would be required to make up for the loss of funding from the federal reimbursement allowance. Because provider taxes serve as a substantial portion of state funding for Medicaid, they free up state general revenue for other priorities like education. As a result, deep cuts throughout the state budget would likely be required to make up for the funding provided by the federal reimbursement allowance.

However, cuts to Medicaid or education (the largest) could put Missouri out of compliance with maintenance of effort requirements in the American Rescue Plan, risking federal funds anticipated to help schools and Missourians counter the consequences of the pandemic.

Provider Taxes Fund State Medicaid Match

The federal reimbursement allowance system began in the early 1990s, when hospitals began voluntarily contributing funds to the state, which could then be used as the state’s Medicaid match to draw down additional federal dollars in support of Medicaid. Since that time, these voluntary provider taxes have been formalized and are paid by nursing facilities, pharmacies, and other providers, and the FRA has become a major funding stream for MO HealthNet – freeing up state general revenue tax dollars for

other state priorities.

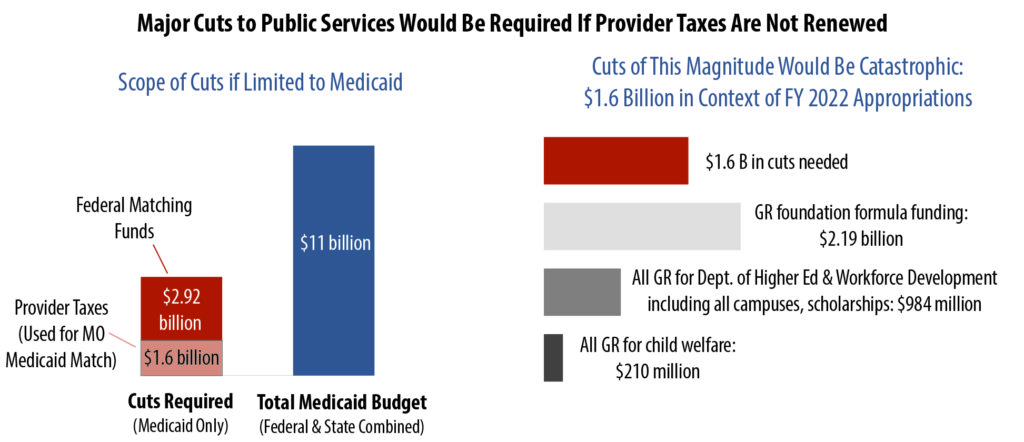

In total, provider taxes are estimated to bring in nearly $1.6 billion in fiscal year 2022 – leveraging more than $2.9 billion in federal funds for Medicaid.

Loss of Provider Tax Would Devastate Budget, Services

The loss of $1.6 billion in provider taxes would destabilize the entire state budget. To address the loss of this funding source, Missouri would need to cut either $4.5 billion from Medicaid, or cut $1.6 billion from education, social services, or other critical services that Missourians rely on every day, or some combination.

Impact on Medicaid

Because the $1.6 billion in state provider taxes draw down federal matching funds, the full loss if concentrated solely on Missouri’s Medicaid program totals more than $4.5 billion. So to maintain existing Medicaid services, which primarily benefit children, seniors, Missourians with disabilities and pregnant moms, lawmakers would need to divert $1.6 billion of the $11 billion general revenue budget from other services to Medicaid.

Implications for Education & Other Services

But diverting $1.6 billion from the state general revenue budget to make up for the loss of provider taxes would require significant cuts to other critical services, including education.

To put the scope of these cuts in context:

- Missouri’s funding for the state’s foundation formula, the primary source of state funding for local schools totals $3.56 billion, with $2.18 billion of that support derived from general revenue.

- The entire budget, including federal and earmarked funds, for the Missouri Department of Higher Education and Workforce development is $1.4 billion, with $984 million of that support coming from general revenue. That figure includes funding for Missouri’s 13 community colleges, 13 public four-year universities (four of which are part of the University of Missouri system), and one state technical college, as well as all its scholarship programs, like Bright Flight and the A+ schools program, and workforce development programs. Core general revenue funding for Missouri’s community colleges, technical schools and 4-year institutions alone is $851 million in the coming budget year.

- Similarly, total funding for the entirety of child welfare services in Missouri is just $450 million with only $210 million coming from state general revenue – just a fraction of the amount needed to make up for the loss of Missouri’s provider taxes.

The state could of course enact a combination of these cuts. However, given the sheer scale of funding, such cuts would be painful to Missourians across our state.

Additional Federal Fiscal Relief Also at Risk

In addition to the direct impact of budget cuts, if they were made during the same years that federal Coronavirus relief packages are in effect, our state risks defying important provisions of those packages that allow Missouri to benefit from funding intended to help states, families, and communities weather the academic, economic, and health consequences of the pandemic.

For instance, additional federal funding for K-12 education, higher education, and Medicaid are dependent on states meeting maintenance

of effort (MOE) requirements. These MOE requirements are meant to ensure the integrity of education, health, and other services that states provide.

Under the federal American Rescue Plan (ARPA) Missouri is slated to receive a total of $1.96 billion in K-12 funding, $631 million in support for higher education, and at least $376 million in enhanced Medicaid funds. Missouri also received allotments of federal funds in previous federal pandemic packages that contained similar MOE provisions. Should Missouri cut state funding for these services it could run afoul of federal MOE requirements, risking the loss of some or all of these federal pandemic response funds.

Further, under the ARPA Missouri is scheduled to receive $2.8 billion in state fiscal relief. That funding is tied to a provision that it can’t be used to offset state tax cuts. The U.S. Treasury may determine that the elimination of Missouri’s provider taxes equate with a tax cut and require that some or all of the $2.8 billion in federal fiscal relief be returned (after accounting for revenue growth and other factors).

Clearly, Medicaid provider taxes are a critical component of support for Missouri’s state budget. The consequences of failing to renew them would be dire: the ramifications would extend to services far beyond Medicaid and be felt by Missourians in every community across our state.