Nearly 46,000 Missourians were overpaid unemployment benefits in 2020, largely due to administrative errors tied to the unprecedented volume of unemployment claims related to the COVID-19 pandemic. Given the hardship repayment would place on families who are already struggling financially, combined with the stimulative impact of additional dollars flowing through Missouri communities, Missouri should forgive repayment of both state and federal unemployment overpayments.

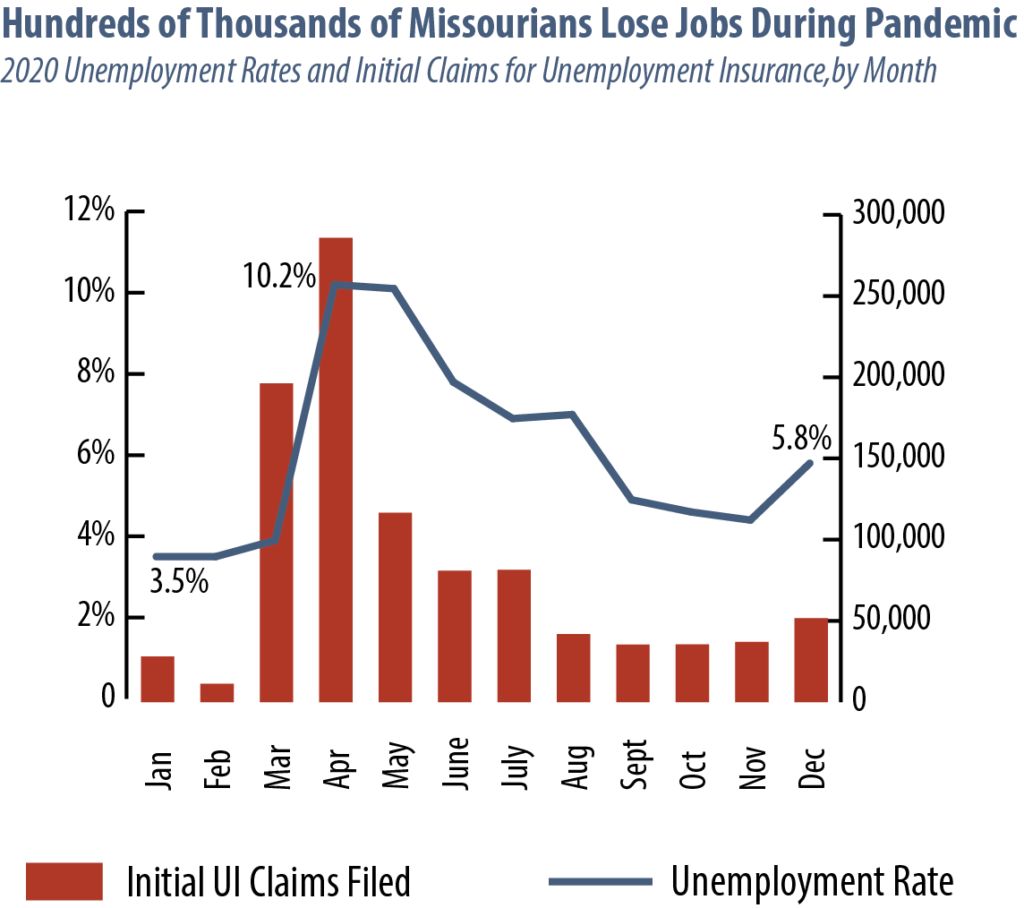

Over the past year, Missouri has seen unprecedented job loss due to the COVID-19 pandemic and the resulting economic crisis. In April, during the peak of stay-at-home orders, more than one in ten workers in Missouri was unemployed, and nearly 286,000 Missourians filed claims for unemployment benefits. As illustrated in this chart, these rates have improved; however, both unemployment rates and unemployment claims remain well above pre-pandemic levels.

Unemployment insurance (UI) is a federal-state partnership that helps many people who have lost their jobs by temporarily replacing part of their wages. In response to these unprecedented unemployment rates, the federal government passed several new Unemployment Insurance (UI) programs as part of federal stimulus packages that were designed to supplement existing state programs. Since March 2020, nearly 489,000 Missourians have received unemployment insurance payments.

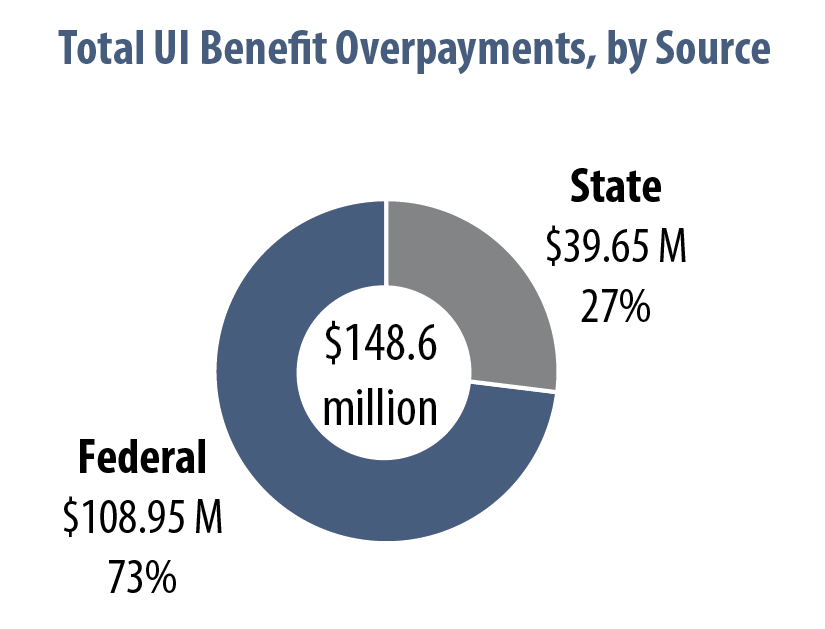

While these programs have provided a lifeline to Missourians who lost employment during the pandemic, challenges in administering rapid federal program changes, exacerbated by an unprecedented volume of claims, led to the state incorrectly overpaying UI benefits to Missourians. The Missouri Department of Labor and Industrial Relations (DLIR) reportedly overpaid 46,000 Missourians federal and state unemployment benefits totaling nearly $150 million. This accounted for around 3% of all UI payments made during calendar year 2020 (See Appendix for overpayments by county).

These overpayments are largely recognized as having been made due to administrative errors, rather than attempts to defraud the system. Attempts to collect overpayments due to administrative errors will only harm the families who were most impacted by the economic fallout due to COVID, many of whom are still struggling to make ends meet under reduced wages.

Requiring repayment would also harm Missouri’s local economies, as families would be forced to divert a significant portion of their incomes to repayment. In effect, requiring repayment would reduce the amount of income that is circulating in local economies at a time when Missouri’s economic conditions remain fragile, and could impede our economic recovery. Alternatively, forgiving both the state and the federal overpayments could have a stimulus effect on Missouri’s recovery, generating an estimated $1.49 in economic activity for each $1 spent on UI benefits.

The federal government has allowed states to waive repayment of federal dollars, but Missouri legislators must pass legislation to allow for forgiveness of these payments. While most state legislative proposals currently address forgiveness of only the federal overpayments, lawmakers can have an even greater impact by forgiving both federal and state overpayments. The $39.65 million in state overpayments would be a one-time cost and could be paid for with federal stimulus funds to fully offset the cost to state General Revenue.

Forgiveness of both state and federal unemployment insurance repayment would not only put dollars directly in the pockets of families struggling to make ends meet, it would also go far to keep dollars flowing through our local communities, thereby bolstering Missouri’s continued economic recovery.

| Total UI Overpayments | Overpayments as Share of Total UI Benefits Paid | Estimated Economic Impact of Overpayments | |

| Missouri | $148,606,861 | 2.9% | $221,424,223 |

| Adair | $225,453 | 4.0% | $335,925 |

| Andrew | $194,471 | 3.7% | $289,762 |

| Atchison | $36,231 | 4.4% | $53,984 |

| Audrain | $341,456 | 3.7% | $508,769 |

| Barry | $368,382 | 2.5% | $548,889 |

| Barton | $131,539 | 4.6% | $195,993 |

| Bates | $127,768 | 2.9% | $190,374 |

| Benton | $248,249 | 3.7% | $369,891 |

| Bollinger | $109,830 | 2.3% | $163,647 |

| Boone | $2,985,692 | 5.3% | $4,448,681 |

| Buchanan | $1,511,406 | 4.3% | $2,251,994 |

| Butler | $718,875 | 4.0% | $1,071,123 |

| Caldwell | $109,773 | 3.9% | $163,562 |

| Callaway | $751,830 | 5.4% | $1,120,227 |

| Camden | $633,395 | 3.2% | $943,759 |

| Cape Girardeau | $1,352,443 | 4.2% | $2,015,140 |

| Carroll | $47,841 | 1.6% | $71,283 |

| Carter | $80,794 | 3.8% | $120,383 |

| Cass | $1,340,364 | 3.8% | $1,997,142 |

| Cedar | $113,302 | 4.1% | $168,820 |

| Chariton | $45,830 | 2.8% | $68,287 |

| Christian | $1,287,913 | 3.7% | $1,918,990 |

| Clark | $60,652 | 6.2% | $90,371 |

| Clay | $4,753,170 | 3.5% | $7,082,224 |

| Clinton | $243,060 | 2.9% | $362,159 |

| Cole | $1,192,330 | 4.8% | $1,776,572 |

| Cooper | $266,008 | 4.4% | $396,351 |

| Crawford | $355,456 | 3.0% | $529,630 |

| Dade | $31,125 | 1.6% | $46,376 |

| Dallas | $123,165 | 2.1% | $183,516 |

| Daviess | $81,093 | 4.8% | $120,829 |

| DeKalb | $78,019 | 3.6% | $116,248 |

| Dent | $112,700 | 2.7% | $167,922 |

| Douglas | $116,660 | 1.9% | $173,823 |

| Dunklin | $412,525 | 4.1% | $614,663 |

| Franklin | $1,838,122 | 3.2% | $2,738,802 |

| Gasconade | $231,734 | 3.2% | $345,284 |

| Gentry | $47,788 | 3.9% | $71,204 |

| Greene | $6,550,600 | 4.9% | $9,760,394 |

| Grundy | $73,136 | 3.0% | $108,972 |

| Harrison | $100,222 | 6.4% | $149,331 |

| Henry | $266,405 | 3.4% | $396,943 |

| Hickory | $64,773 | 2.9% | $96,512 |

| Holt | $17,122 | 1.8% | $25,512 |

| Howard | $102,417 | 4.0% | $152,601 |

| Howell | $608,723 | 2.9% | $906,997 |

| Iron | $136,918 | 3.8% | $204,008 |

| Jackson | $15,438,935 | 3.9% | $23,004,013 |

| Jasper | $1,999,602 | 4.1% | $2,979,406 |

| Jefferson | $4,747,786 | 3.9% | $7,074,201 |

| Johnson | $657,617 | 3.9% | $979,849 |

| Knox | $26,977 | 2.1% | $40,196 |

| Laclede | $588,011 | 2.4% | $876,137 |

| Lafayette | $385,102 | 3.3% | $573,802 |

| Lawrence | $446,111 | 3.0% | $664,706 |

| Lewis | $83,628 | 5.1% | $124,606 |

| Lincoln | $1,004,265 | 3.5% | $1,496,354 |

| Linn | $106,535 | 2.7% | $158,737 |

| Livingston | $86,824 | 2.5% | $129,368 |

| Macon | $114,667 | 2.6% | $170,854 |

| Madison | $168,112 | 3.1% | $250,487 |

| Maries | $106,131 | 3.8% | $158,135 |

| Marion | $352,692 | 4.1% | $525,511 |

| McDonald | $199,999 | 1.8% | $297,999 |

| Mercer | $21,568 | 3.2% | $32,136 |

| Miller | $437,362 | 3.4% | $651,669 |

| Mississippi | $139,933 | 2.3% | $208,500 |

| Moniteau | $124,721 | 3.1% | $185,834 |

| Monroe | $64,147 | 2.0% | $95,579 |

| Montgomery | $101,212 | 2.2% | $150,805 |

| Morgan | $338,023 | 4.4% | $503,655 |

| New Madrid | $142,354 | 1.9% | $212,108 |

| Newton | $902,238 | 4.2% | $1,344,335 |

| Nodaway | $208,648 | 4.6% | $310,886 |

| Oregon | $105,047 | 3.4% | $156,520 |

| Osage | $127,768 | 4.6% | $190,374 |

| Ozark | $81,605 | 3.3% | $121,592 |

| Pemiscot | $243,815 | 3.6% | $363,285 |

| Perry | $255,057 | 2.7% | $380,035 |

| Pettis | $785,122 | 3.7% | $1,169,832 |

| Phelps | $575,022 | 4.4% | $856,782 |

| Pike | $225,505 | 1.3% | $336,002 |

| Platte | $1,497,878 | 3.6% | $2,231,839 |

| Polk | $447,989 | 5.0% | $667,503 |

| Pulaski | $542,044 | 4.8% | $807,646 |

| Putnam | $31,257 | 4.3% | $46,573 |

| Ralls | $112,931 | 3.5% | $168,267 |

| Randolph | $257,915 | 2.6% | $384,294 |

| Ray | $395,001 | 3.6% | $588,551 |

| Reynolds | $55,529 | 2.5% | $82,739 |

| Ripley | $180,374 | 3.1% | $268,758 |

| Saline | $236,040 | 4.0% | $351,700 |

| Schuyler | $26,114 | 2.6% | $38,910 |

| Scotland | $32,995 | 6.8% | $49,163 |

| Scott | $649,376 | 3.7% | $967,570 |

| Shannon | $130,725 | 4.0% | $194,780 |

| Shelby | $37,275 | 2.3% | $55,540 |

| St. Charles | $6,748,049 | 3.6% | $10,054,594 |

| St. Clair | $71,646 | 2.8% | $106,753 |

| St. Francois | $1,055,057 | 3.3% | $1,572,035 |

| St. Louis | $22,383,008 | 3.5% | $33,350,682 |

| St. Louis City | $9,646,277 | 3.6% | $14,372,952 |

| Ste. Genevieve | $277,041 | 4.0% | $412,792 |

| Stoddard | $420,125 | 3.7% | $625,986 |

| Stone | $636,817 | 2.3% | $948,857 |

| Sullivan | $49,064 | 4.1% | $73,105 |

| Taney | $2,413,851 | 3.4% | $3,596,637 |

| Texas | $214,016 | 3.5% | $318,885 |

| Vernon | $195,969 | 4.2% | $291,993 |

| Warren | $483,482 | 2.7% | $720,389 |

| Washington | $336,533 | 2.5% | $501,434 |

| Wayne | $128,565 | 2.7% | $191,562 |

| Webster | $538,252 | 4.1% | $801,996 |

| Worth | $22,853 | 6.4% | $34,051 |

| Wright | $188,845 | 2.7% | $281,379 |

| Interstate | $6,680,199 | 0.3% | $9,953,497 |