Tax Changes Leave State Unable to Meet Inflationary Costs

Recently announced growth in Missouri’s state general revenue collections may be misleading because the growth is based on a comparison to very weak collections in the prior year. Taking a more comprehensive view shows that over two years, Missouri’s state general revenue collections grew well below the pace needed to account for inflation.

Further, comparing Missouri’s annual revenue growth with the nation and neighboring states confirms just how far behind the state has fallen in its ability to invest in vital public services including education, health and infrastructure.

General Revenue Growth Over Time

The Missouri Office of Administration recently announced that state general revenue collections to date for the current state fiscal year had increased nearly 5.2 percent compared to last year. While this suggests strong growth in the state’s capacity to address its needs, the growth rate is inflated because this year’s collections are being compared to a time in which state general revenue actually declined.

The growth in the current budget year (Fiscal Year 2020 – FY 2020) is compared to the same period in FY 2019 during which state general revenue dropped by 2.9 percent compared to the previous year. Although the FY 2019 revenue situation did improve over time, the growth rate at the end of the fiscal year was just 1.4 percent, by no means a record-setting year.

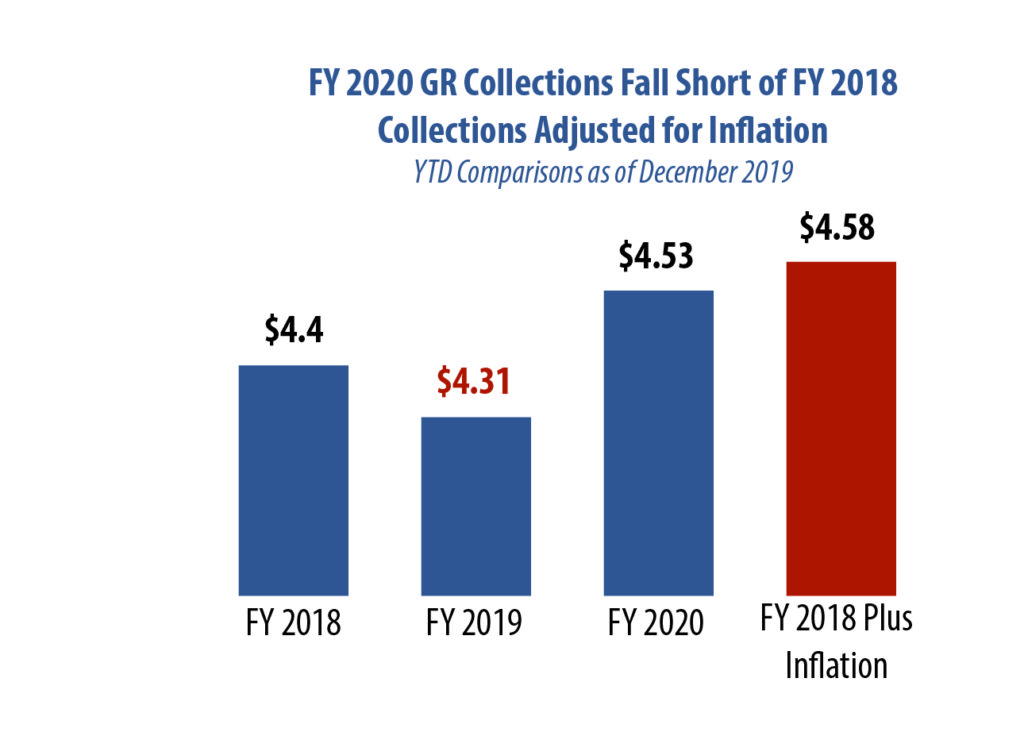

Comparing the current level of state general revenue with the level of revenue two years ago provides a deeper perspective. In nominal terms, over the two-year period, state general revenue was just 2.9 percent higher at the end of December than it was at the same point two years ago in the FY 2018 budget year.

This level of growth is well below the level needed just to meet inflation over the same time. According to the U.S Department of Labor, general cost inflation over the two-year period would have required state general revenue to grow by four percent simply to provide the same services, not accounting for increased costs due to a larger number of students attending public schools or an increase in seniors due to an aging population who may need health, nutrition and caregiver services.

Missouri Growth Compared to Other States

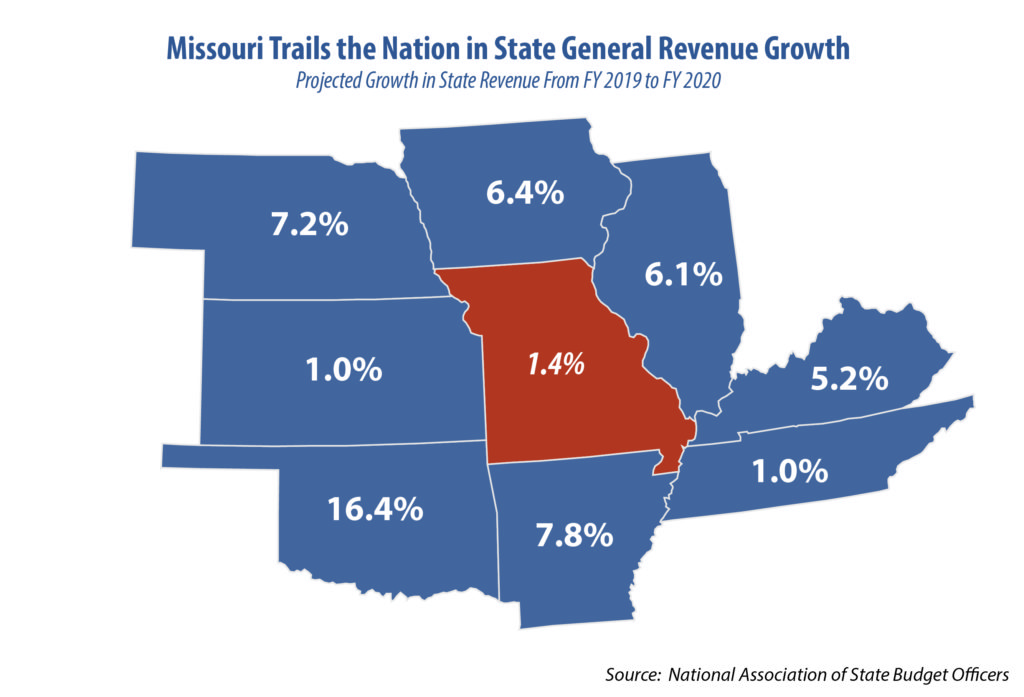

Perhaps more significant, while Missouri’s state general revenue struggles to meet inflationary needs, state general funds have grown significantly across the nation. According to data from the National Association of State Budget Officers, the average growth in state general revenue nationwide

was 4.5 percent in FY 2019, while the median growth was 5.4 percent. Meanwhile, Missouri’s growth rate of 1.4 percent was tenth lowest in the nation. Further, the majority of neighboring states far outpaced Missouri.

The strong growth across the country allowed states to invest in critical services, pay down outstanding debt and shore up state rainy day funds to defend against the next recession or respond to natural disasters.

Nationwide in their FY 2020 budgets:

• 45 states increased funding for elementary and secondary education by $14.8 billion, supporting increases in enrollment, teacher pay raises and

expansions of preschool; and

• 44 states increased support for higher education by $4.4 billion, increasing financial aid and support for workforce development.

Further, by the end of FY 2019, 41 states increased their state rainy day funds – or state savings accounts – raising them to an all-time high as a percent of the state general revenue funding, with a median of 7.6 percent. By comparison, Missouri’s rainy day fund was just 6.8 percent of the state general revenue funding in FY 2019.

“Wayfair Fix” and Revenue Changes

At least a portion of the ability of states to increase investments in public services is directly connected to state tax changes that were made across the nation in 2019.

• 22 states approved tax increases that will generate $7.1 billion in new revenue to support their FY 2020 budgets.

• In addition, a number of states took action to address the Supreme Court’s “Wayfair vs. South Dakota” decision, and implemented steps to collect sales tax that is due for online retail purchases.

While not a tax increase, the “Wayfair Fix” requires online retailers to capture state and local sales taxes in the same way that bricks-and-mortar retailers do, generating increased revenue for states and localities.

Of the 45 states that collect state sales tax, only Missouri and Florida have not taken steps to close this loophole.

Missouri can strengthen its ability to invest in critical services, pay down debt and strengthen the state’s rainy day if lawmakers adopt the Wayfair Fix in the 2020 Legislative Session.